Seize the chance to earn interest with Deposit Plus

Earn higher potential interest as you exchange your money into 11 major currencies at the exchange rate you set. Meet FX needs such as expenses of travelling abroad, paying for your children's overseas tuition fees, and investing in a foreign country. All you need is HKD5,000 (or its equivalent in other currencies) to get started.

Key features

Generate higher potential interest

Generate interest and capture the chance to increase potential return, even when the foreign exchange market is stagnant

The chance to exchange at a better rate

You'll have the chance to exchange your preferred currency at your pre-defined rate, which might be better than the initial rate with no FX exchange spread[@initialrate]

Choose your preferred tenor

Opt from a range of currency pairs with investment tenors as short as one week

Market snapshot

Deposit Plus interest rate (p.a.)

| Deposit currency | Linked currency |

Tenor |

Interest rate (p.a.) |

|---|---|---|---|

| USD | JPY | 7 Days | 12.50% |

| USD | AUD | 7 Days | 11.50% |

| AUD | JPY | 7 Days | 11.50% |

| Deposit currency | USD |

|---|---|

| Linked currency |

JPY |

| Tenor |

7 Days |

| Interest rate (p.a.) | 12.50% |

| Deposit currency | USD |

| Linked currency |

AUD |

| Tenor |

7 Days |

| Interest rate (p.a.) | 11.50% |

| Deposit currency | AUD |

| Linked currency |

JPY |

| Tenor |

7 Days |

| Interest rate (p.a.) | 11.50% |

The above interest rates are indicative only. They are not guaranteed and are subject to revision as per prevailing market conditions.

Top 5 currency pairs

| Ranking | Deposit currency |

Linked currency |

|---|---|---|

| 1 | HKD, USD | AUD |

| 2 | AUD | HKD, USD |

| 3 | HKD, USD | GBP |

| 4 | HKD, USD | EUR |

| 5 | JPY | HKD, USD |

| Ranking | 1 |

|---|---|

| Deposit currency |

HKD, USD |

| Linked currency |

AUD |

| Ranking | 2 |

| Deposit currency |

AUD |

| Linked currency |

HKD, USD |

| Ranking | 3 |

| Deposit currency |

HKD, USD |

| Linked currency |

GBP |

| Ranking | 4 |

| Deposit currency |

HKD, USD |

| Linked currency |

EUR |

| Ranking | 5 |

| Deposit currency |

JPY |

| Linked currency |

HKD, USD |

Currency pairs in this table are ranked in descending order according to transaction volume as recorded by HSBC in Hong Kong during the specified period.

How does Deposit Plus work?

| Deposit Currency | Linked Currency |

Tenor |

Spot rate (AUD / HKD) | Conversion rate (AUD / HKD) | Interest Rate |

|---|---|---|---|---|---|

| HKD | AUD | 14 days |

5.2228 | 5.2209 | 6.50% p.a. |

| Deposit Currency | HKD |

|---|---|

| Linked Currency |

AUD |

| Tenor |

14 days |

| Spot rate (AUD / HKD) | 5.2228 |

| Conversion rate (AUD / HKD) | 5.2209 |

| Interest Rate | 6.50% p.a. |

Fees and charges

Generally, you won't be charged any additional fees when you invest in Deposit Plus. Any operational, administrative and hedging costs, etc. are covered when we calculate the return and/or other variables.

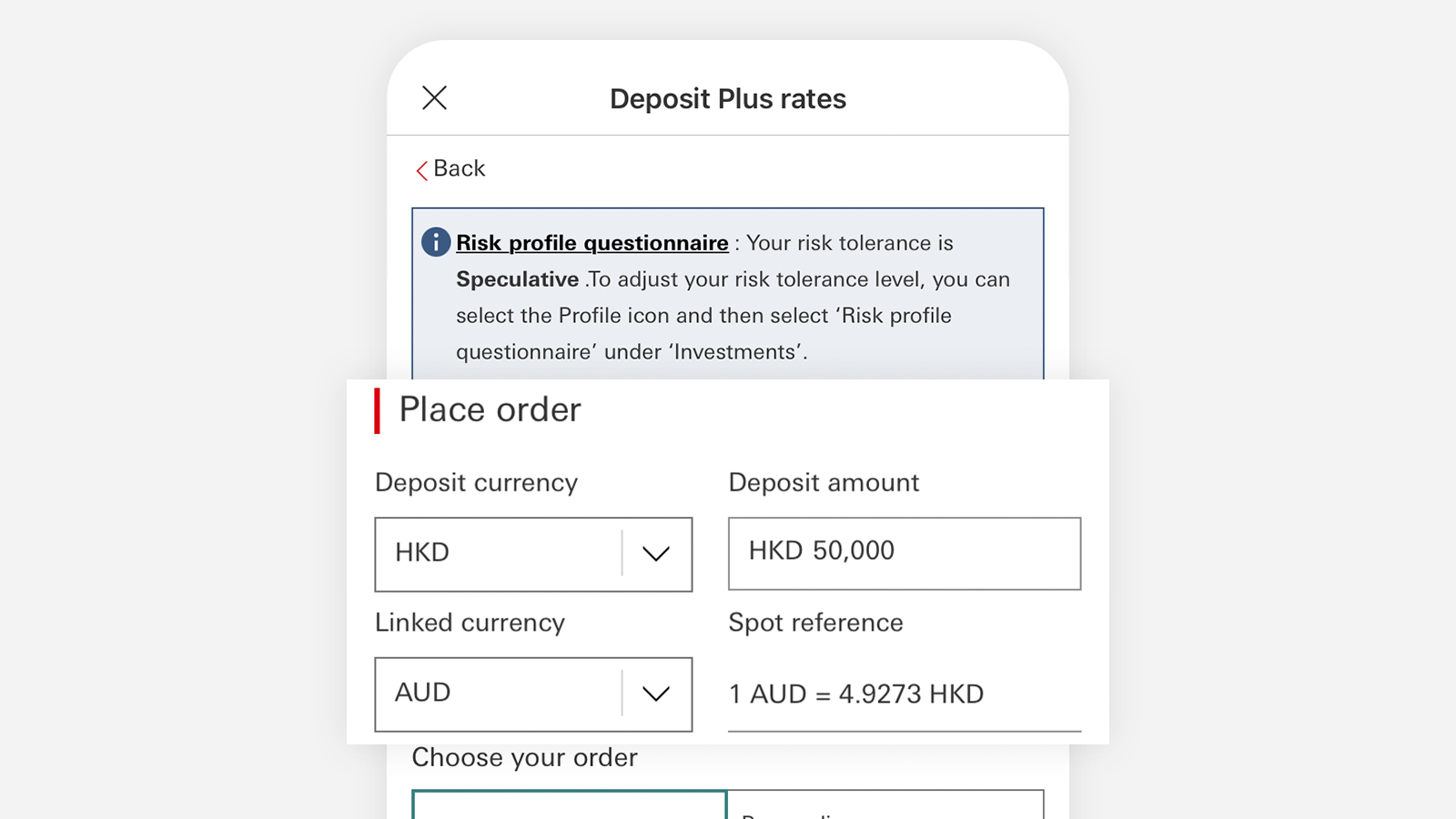

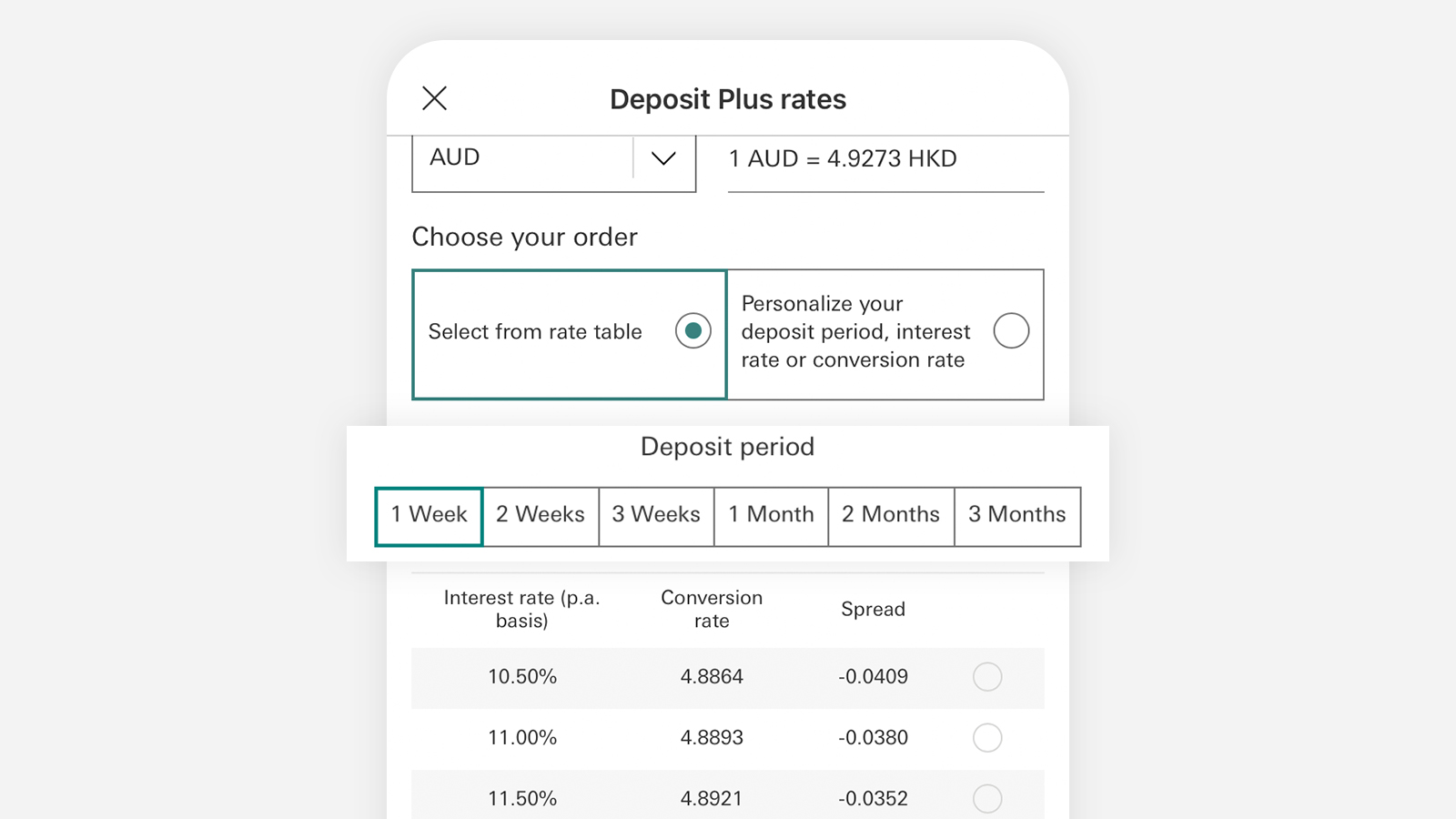

Set up a Deposit Plus in just 3 steps

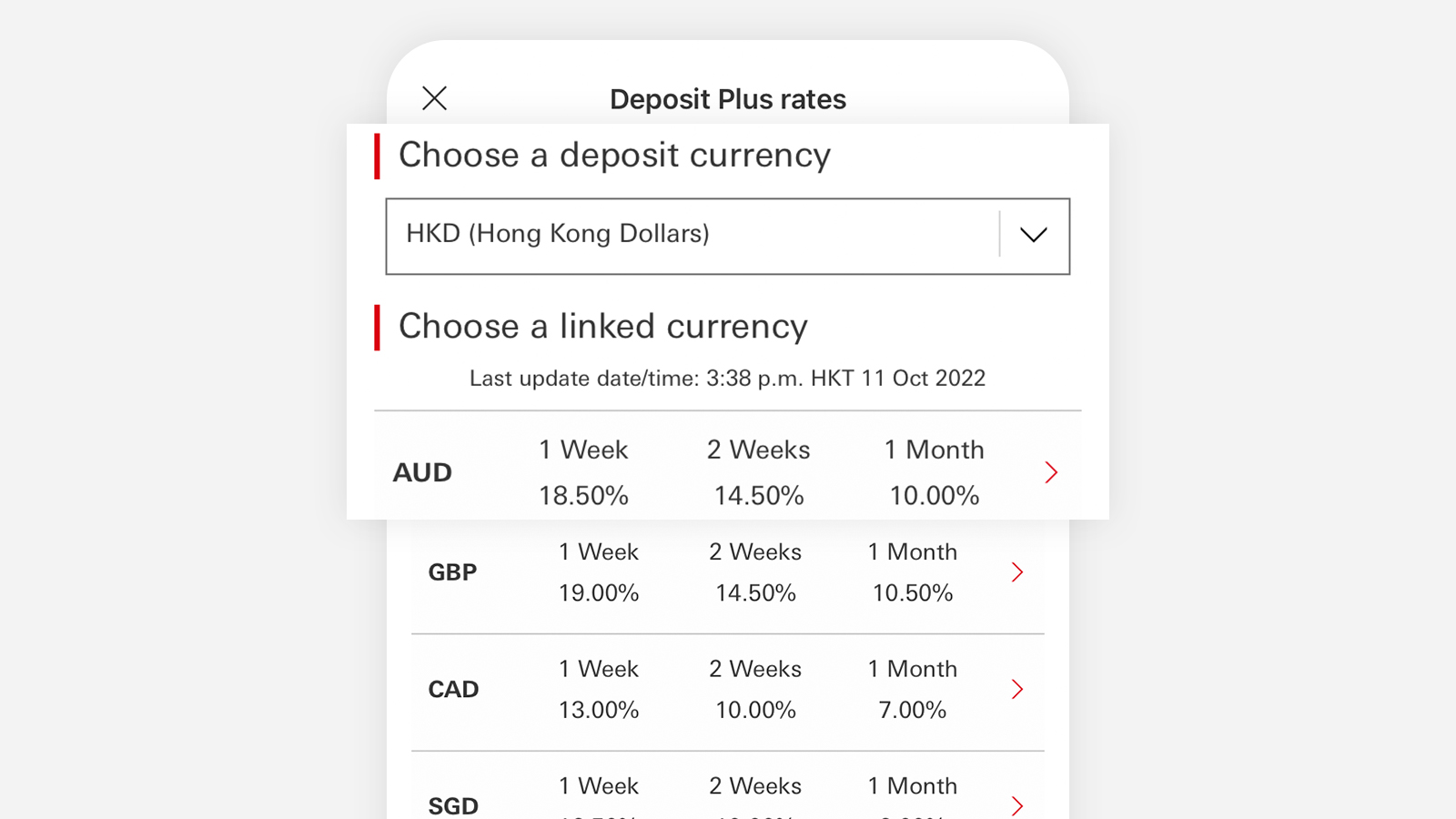

1. Choose your deposit and linked currencies

Available currencies include AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, NZD, SGD and USD.

2. Enter a deposit amount and choose a tenor

Tenors range from as short as 1 week to 3 months.

3. Set your desired conversion or interest rate

At maturity, determined by the exchange rate on the fixing date to receive principal and interest in the deposit currency or linked currency at the predetermined conversion rate.

Ready to set up a Deposit Plus?

Via HSBC Online Banking

Log on to HSBC Online Banking now to get started.

Via the HSBC HK Mobile Banking app

You can also set up a Deposit Plus through the HSBC HK Mobile Banking app.

Award-winning Deposit Plus platform

Excellence Performance in Digital Trading Platform

HSBC won the top award for 'Digital Trading Platform' at the Bloomberg Businessweek – Financial Institution Awards in 2023

Best Digital Wealth Platform

HSBC won the top award of 'Best Digital Wealth Platform' at The Digital Banker - Global Retail Banking Innovation Awards 2023

Find out more

You may also be interested in

How does Deposit Plus work?

See how a Deposit Plus may work for you depending on the appreciation or depreciation of the linked currency.

Equity-linked investments

Tap into the potential of Hong Kong and US equity market movements and earn higher potential income even when the market is range-bound

Capital Protected Investment – Currency Linked III

Take advantage of the foreign exchange market with 100% principal protection at maturity