Place maturity instruction for your time deposit

You can place this instruction at the time of deposit placement and change it one working day before the maturity date.

Change the maturity instruction for your time deposit[@allvert-screenshotmobilex]

You can change the maturity instruction for your time deposit on the HSBC HK App before the maturity date in just a few steps, including setting it to automatically renew.

Please note that if you choose automatic renewal, we'll keep renewing your deposit until you instruct otherwise. The interest rate will be the prevailing standard interest rate on the date of renewal.

If you do not choose automatic renewal, we'll credit your principal amount and interest to your designated deposit account on the maturity date.

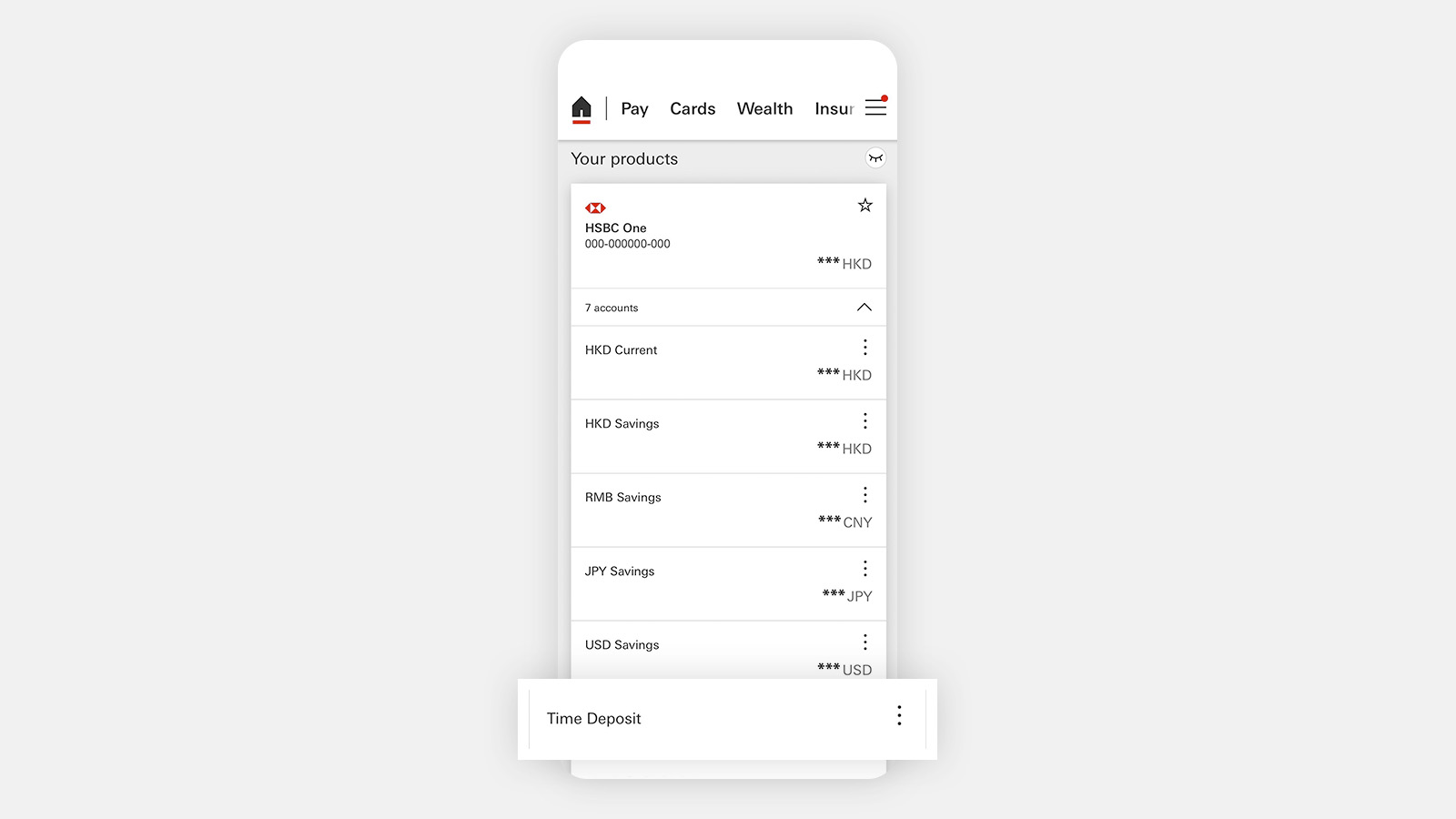

Step 1

Log on to the HSBC HK App, select your bank account, and open up to see the accounts under it. Next, choose 'Time Deposit'. |

|

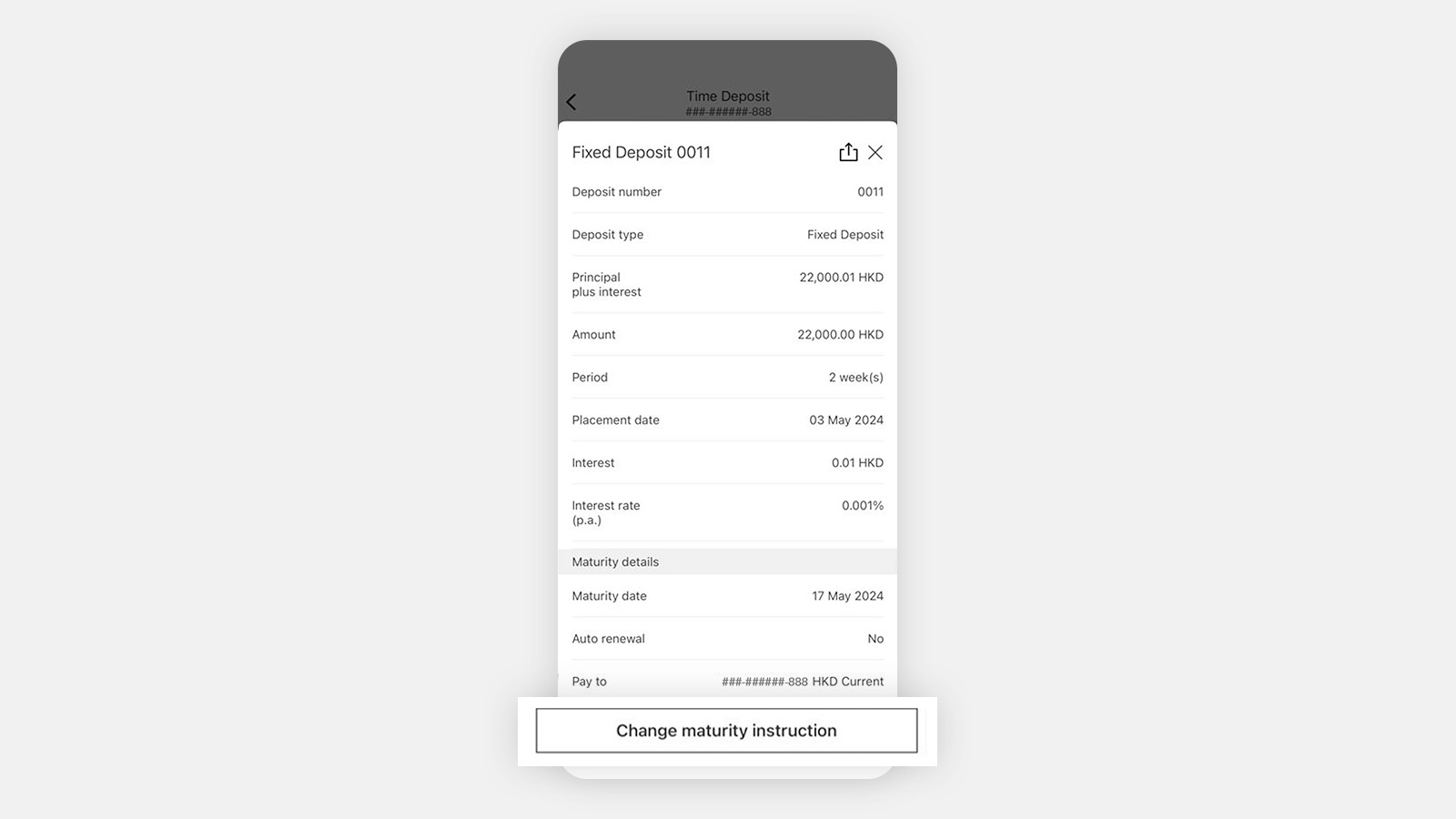

Step 2

Step 3

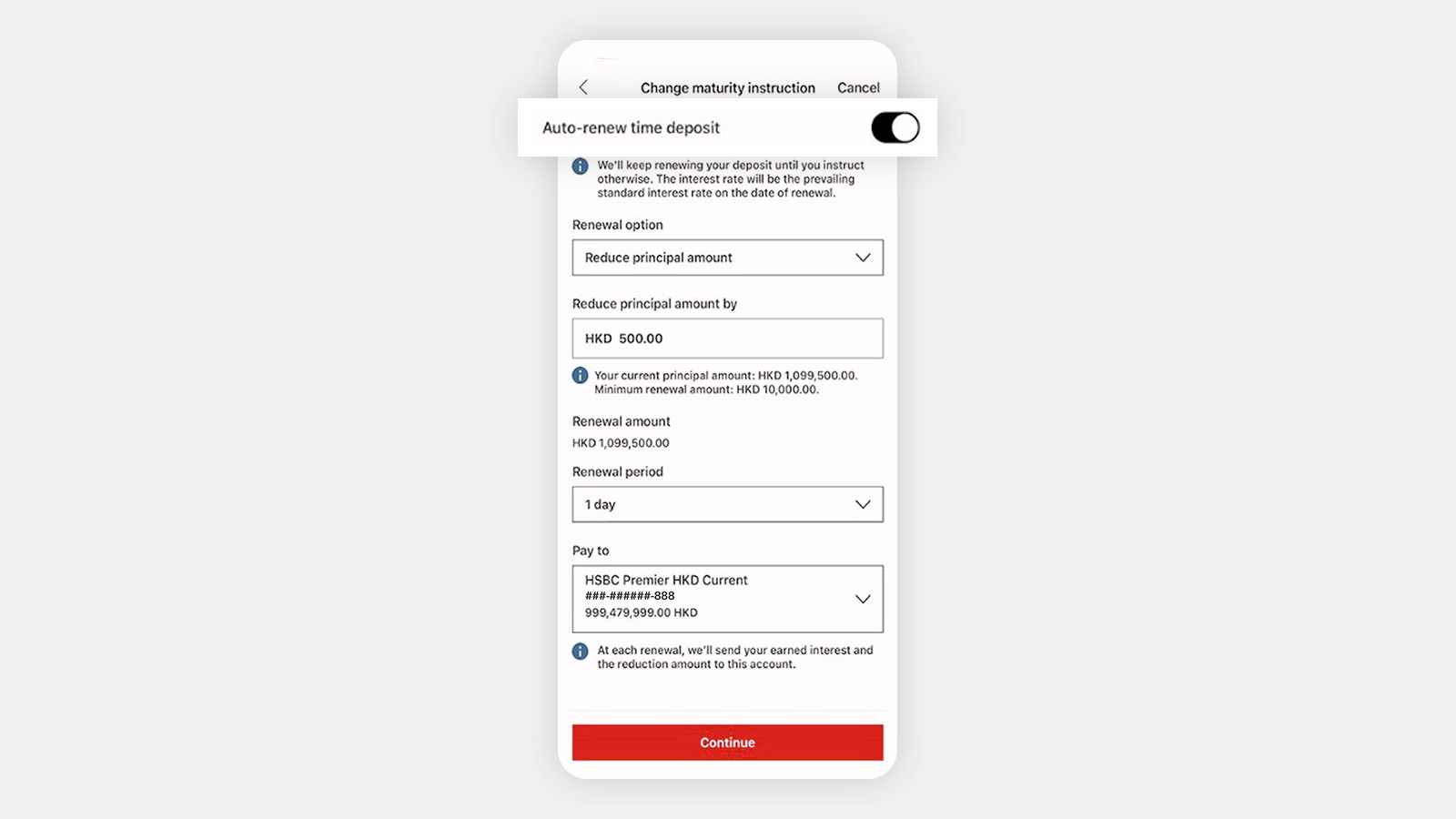

Turn on or off 'Auto-renew time deposit', and make your changes. You can set the renewal amount and renewal period. You can also set the account that the principal and/or interest will be paid to, and/or how much you want to add to the principal amount at renewal.

Next, select ‘Continue’.

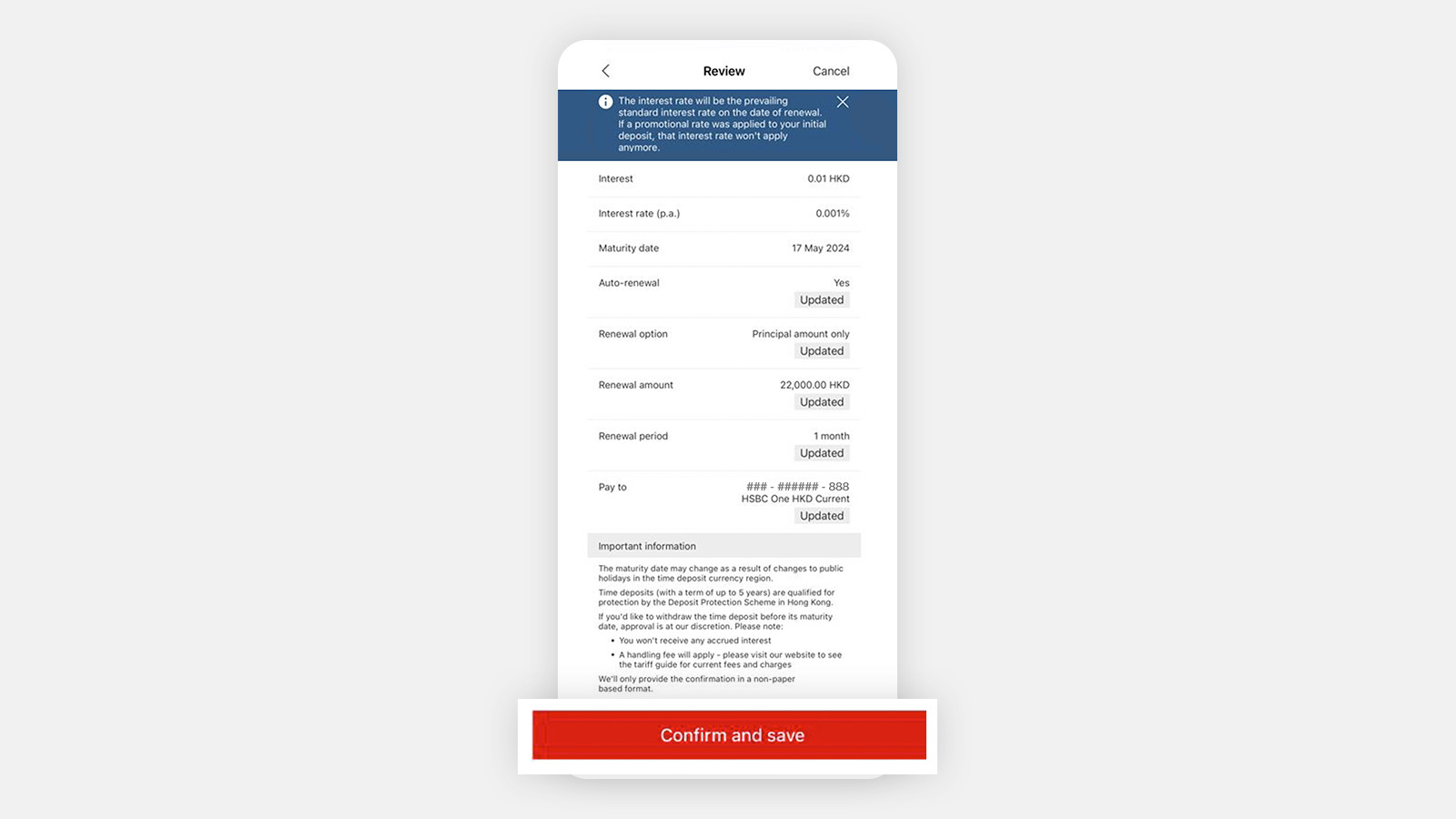

Step 4

Review your amended instructions. Then select ‘Confirm and save’ to submit them.

Note: You’ll see a confirmation page if the changes were successfully made. It’ll say ‘Changes saved’.