Logging on made easier with the HSBC HK App

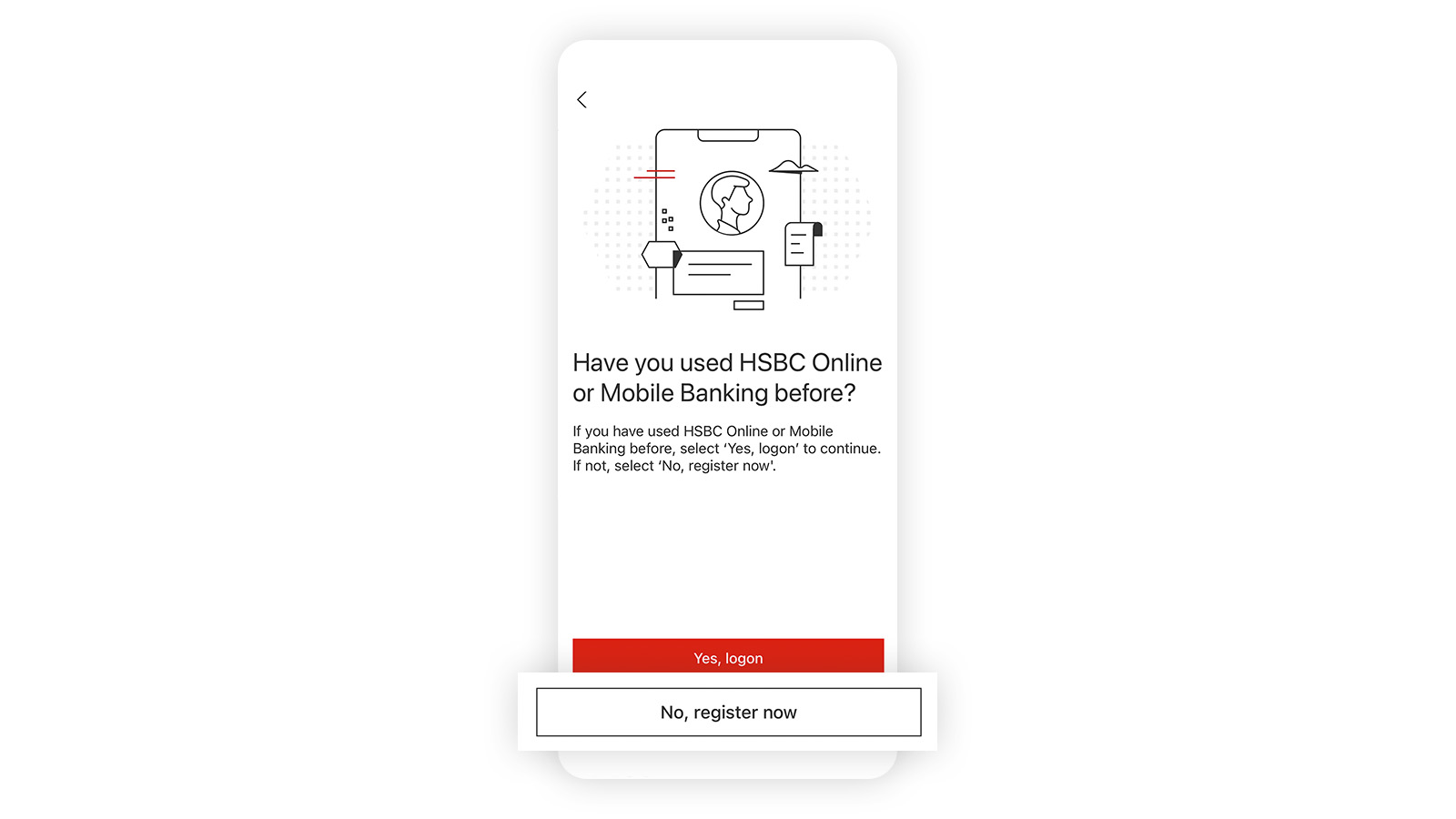

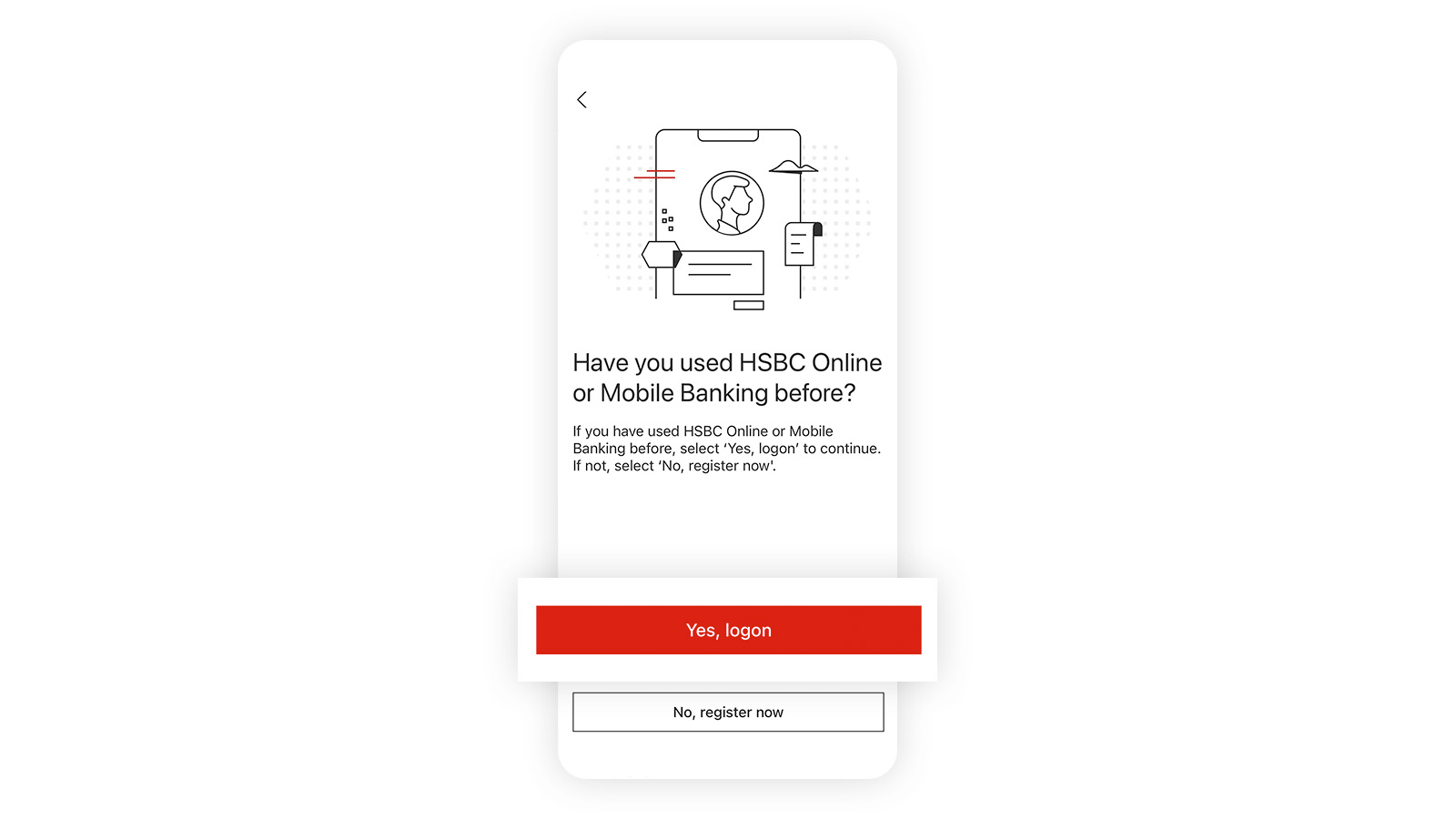

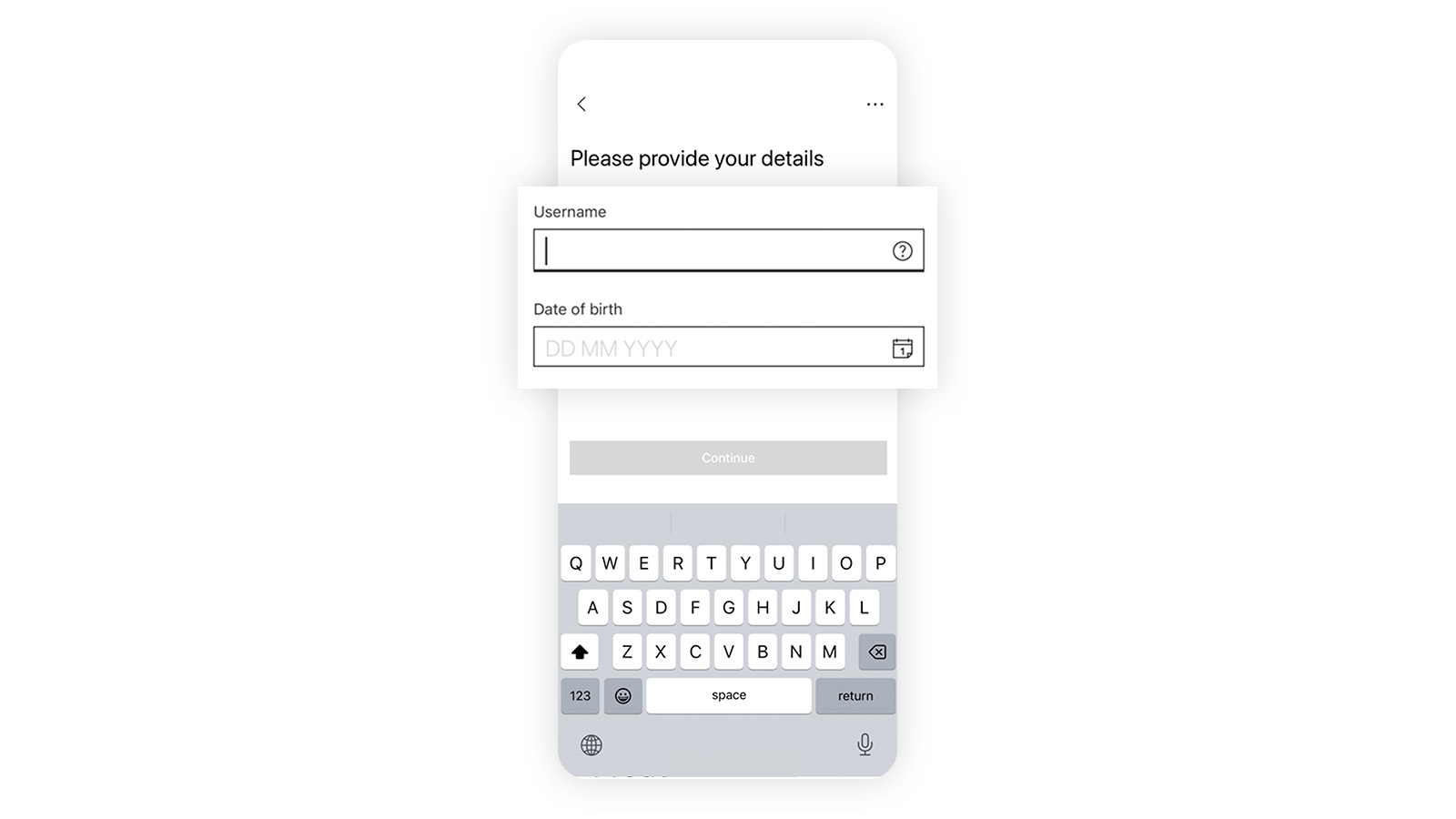

Set up the HSBC HK App

Whether you're new to HSBC Digital Banking services or have only used HSBC Online Banking, you can set up the HSBC HK App in just a few simple steps. Please keep your valid mobile number and email address updated on your bank record.

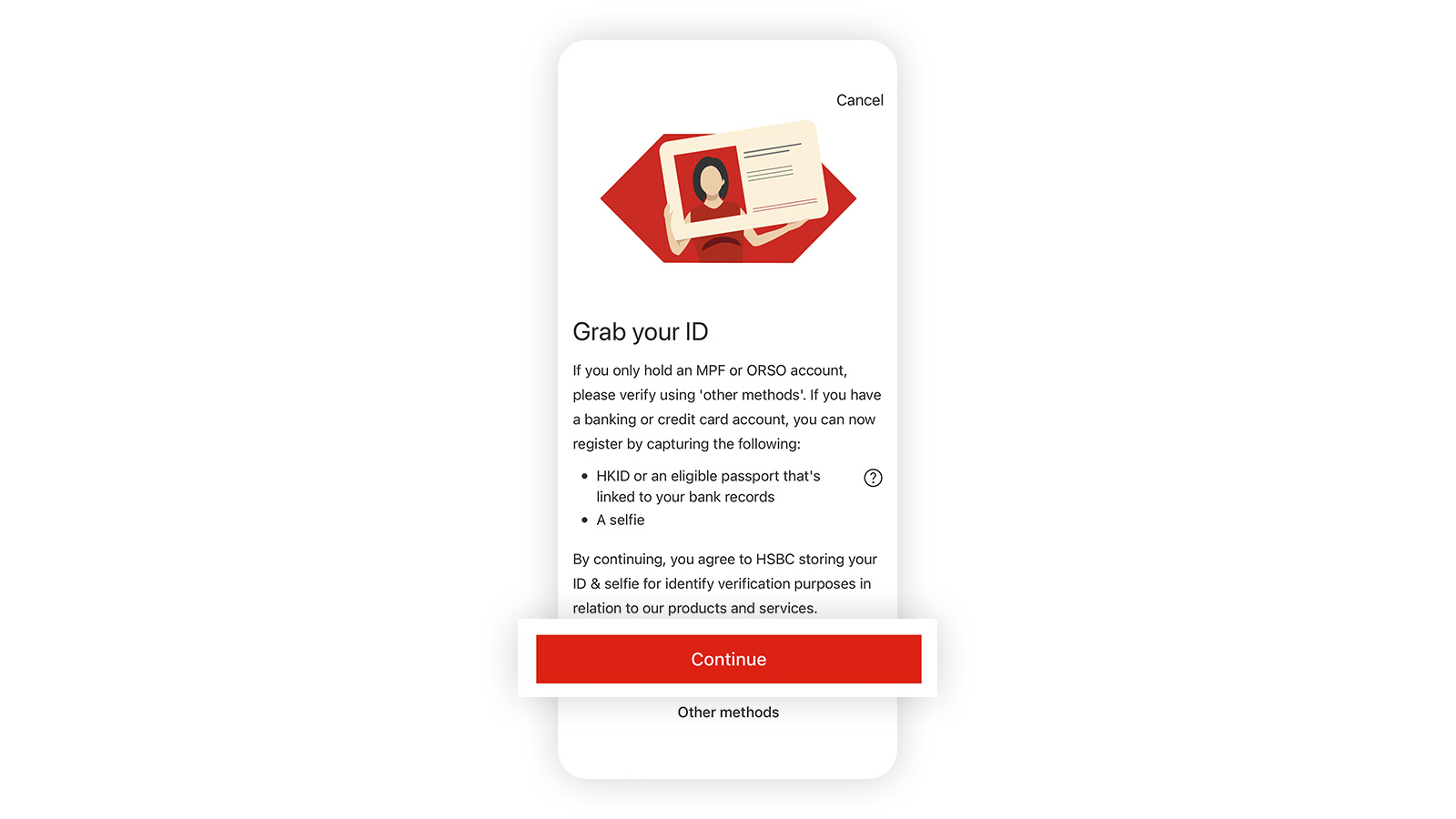

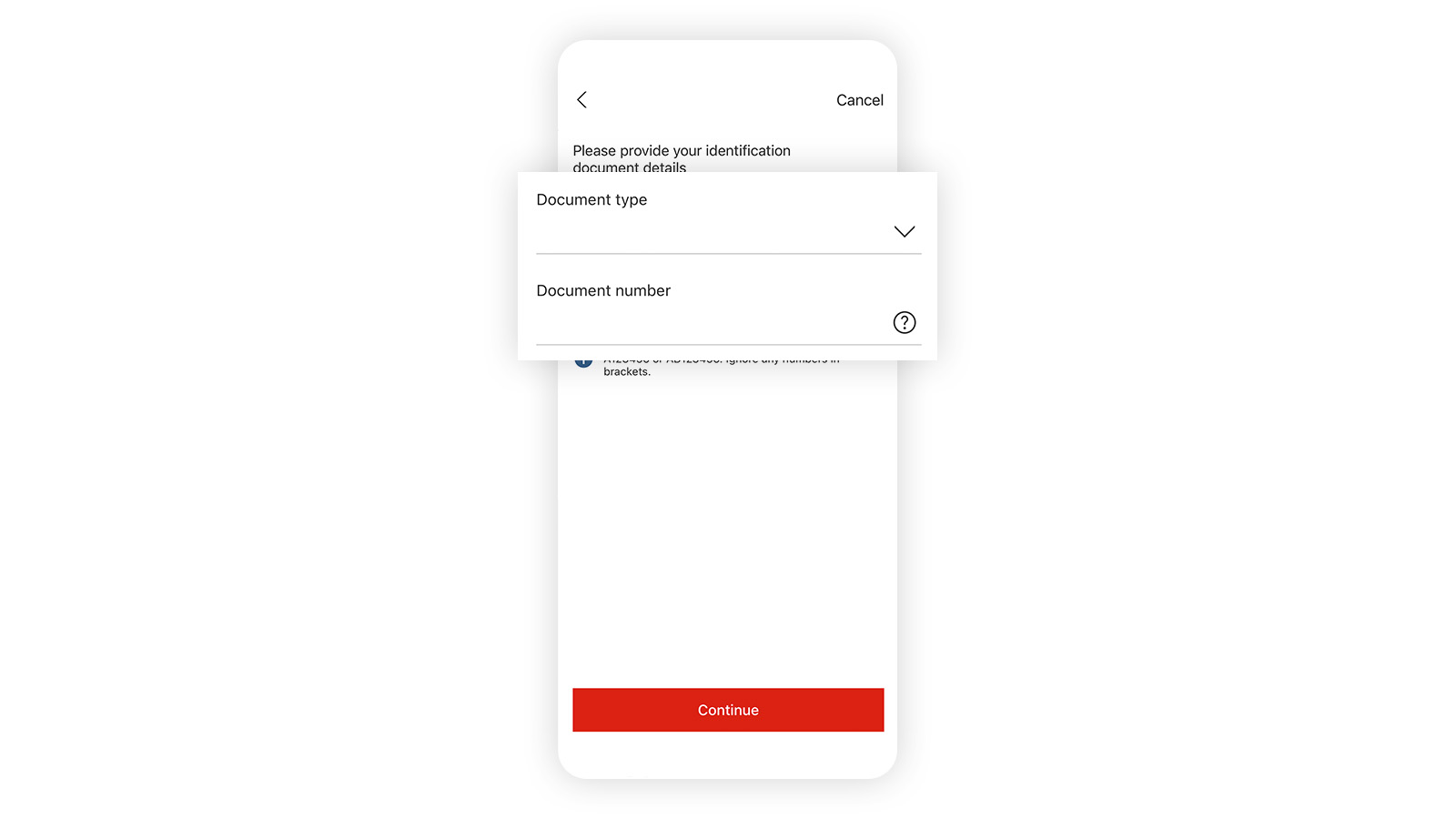

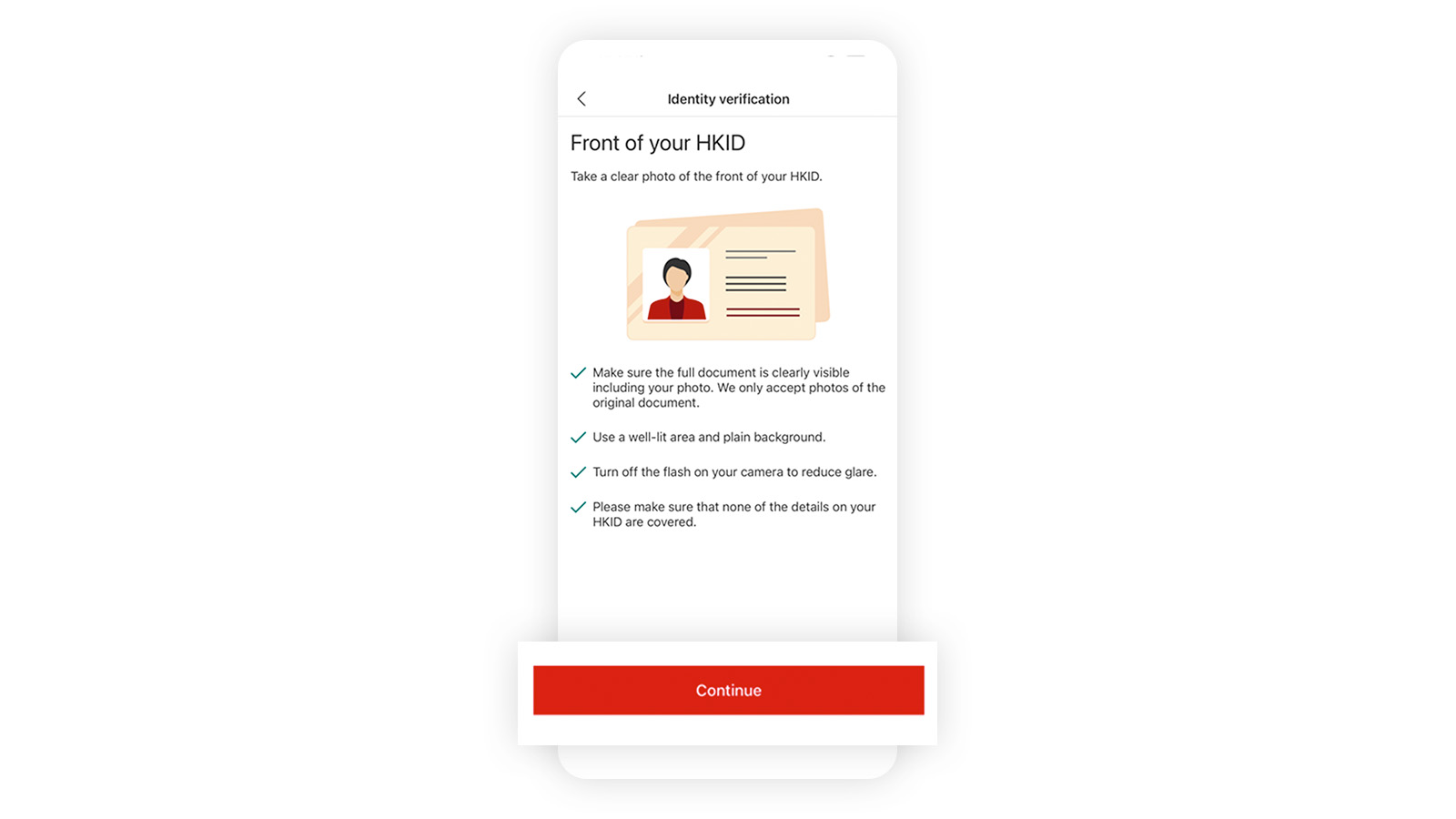

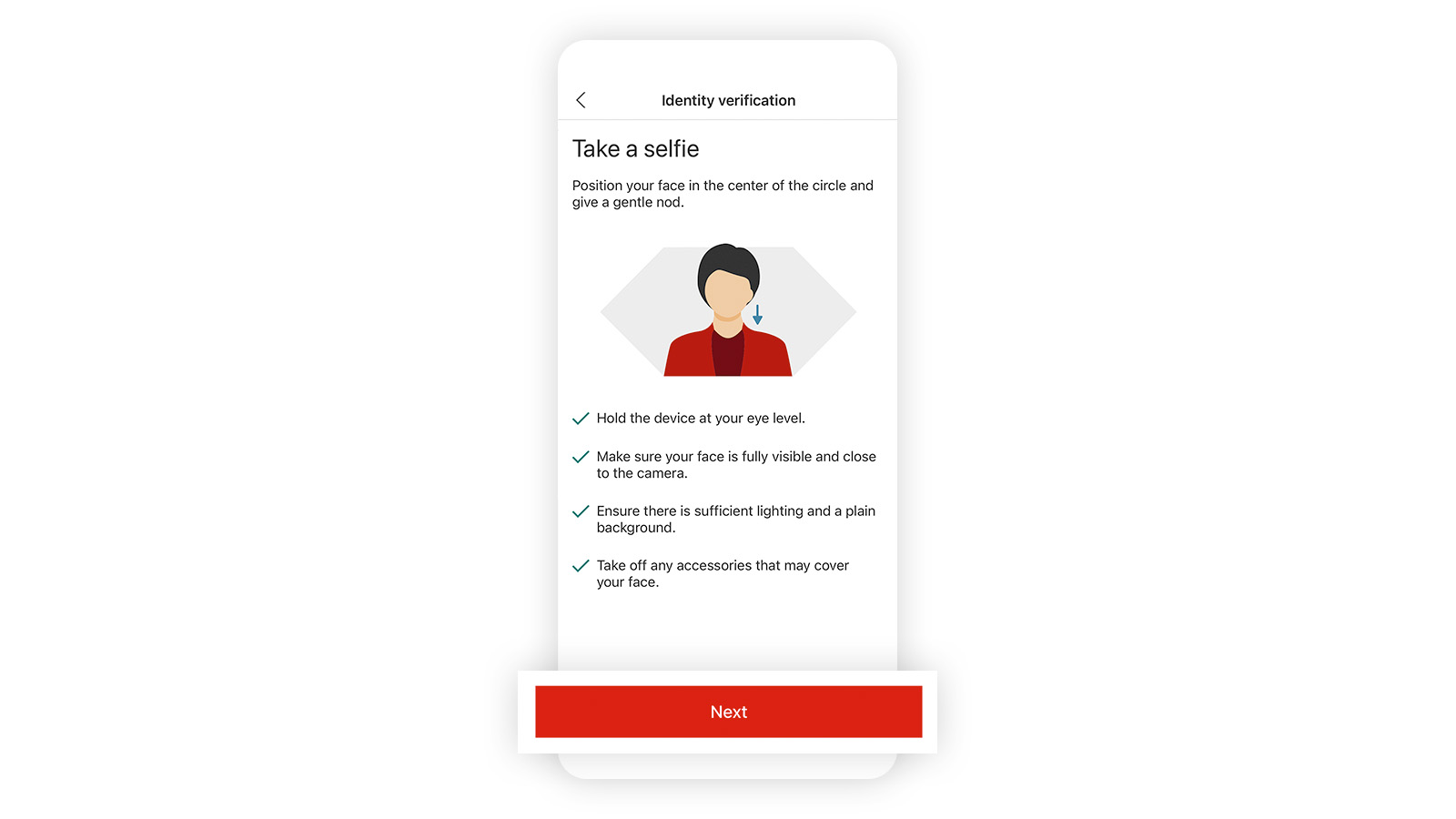

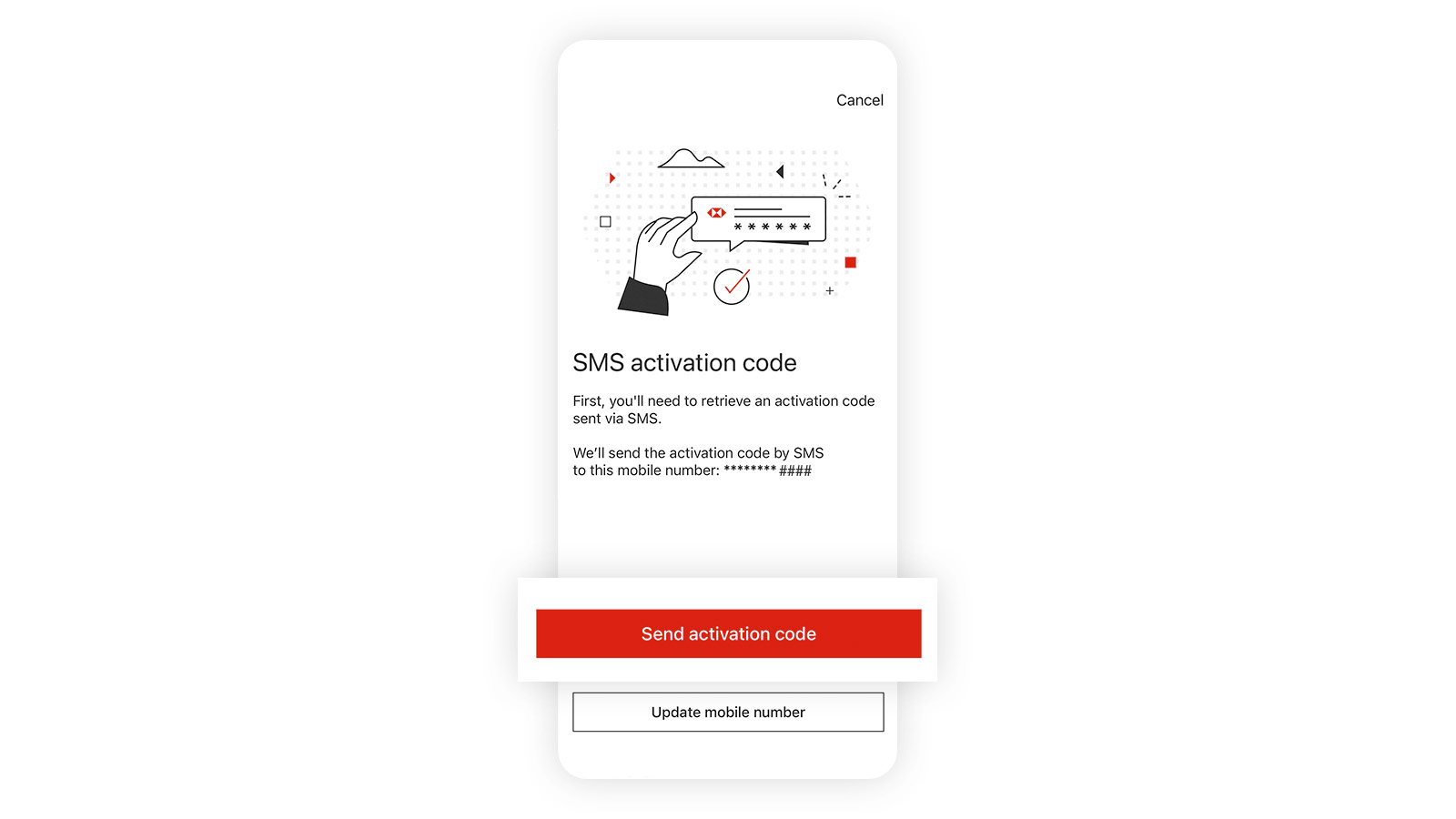

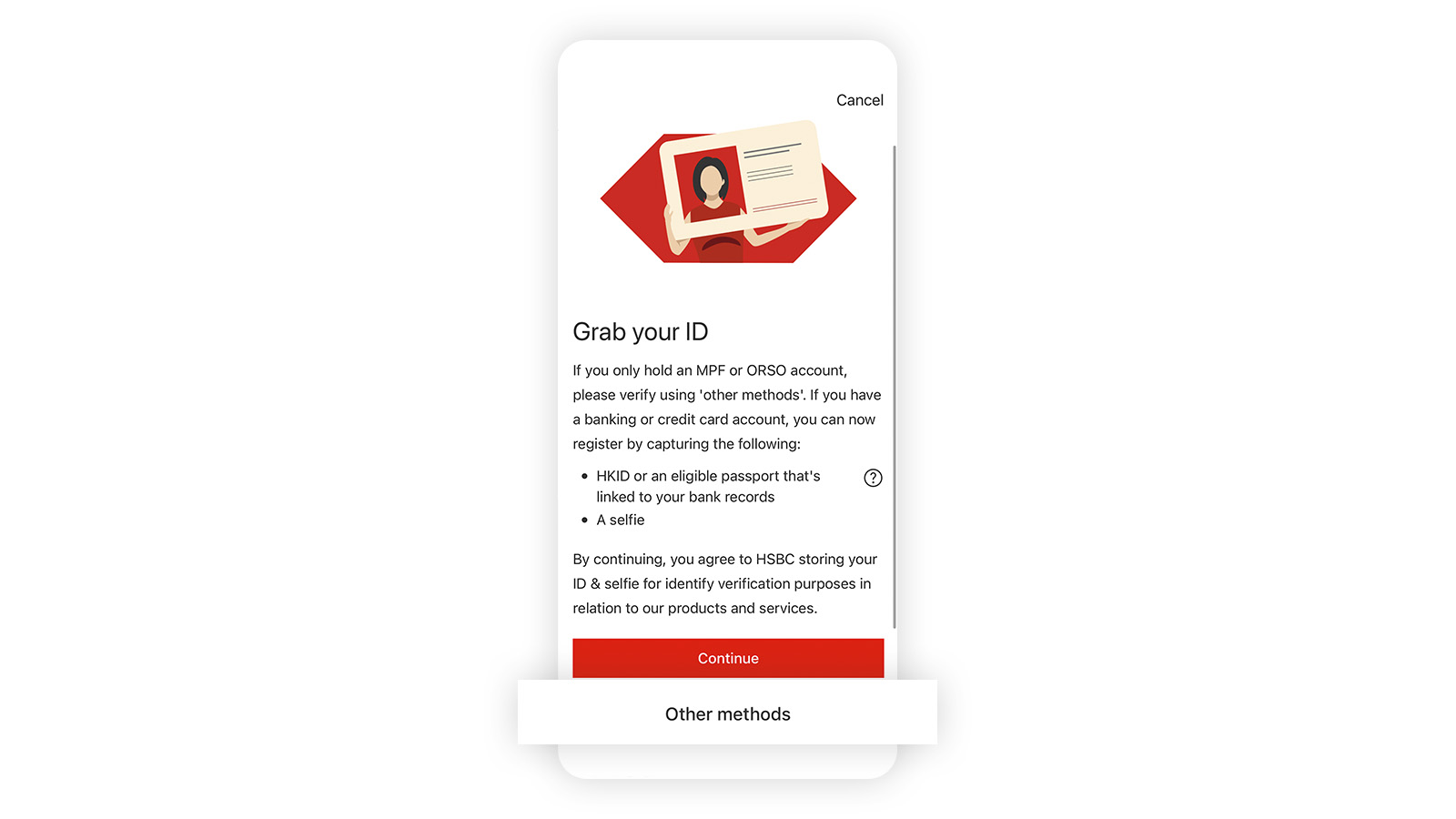

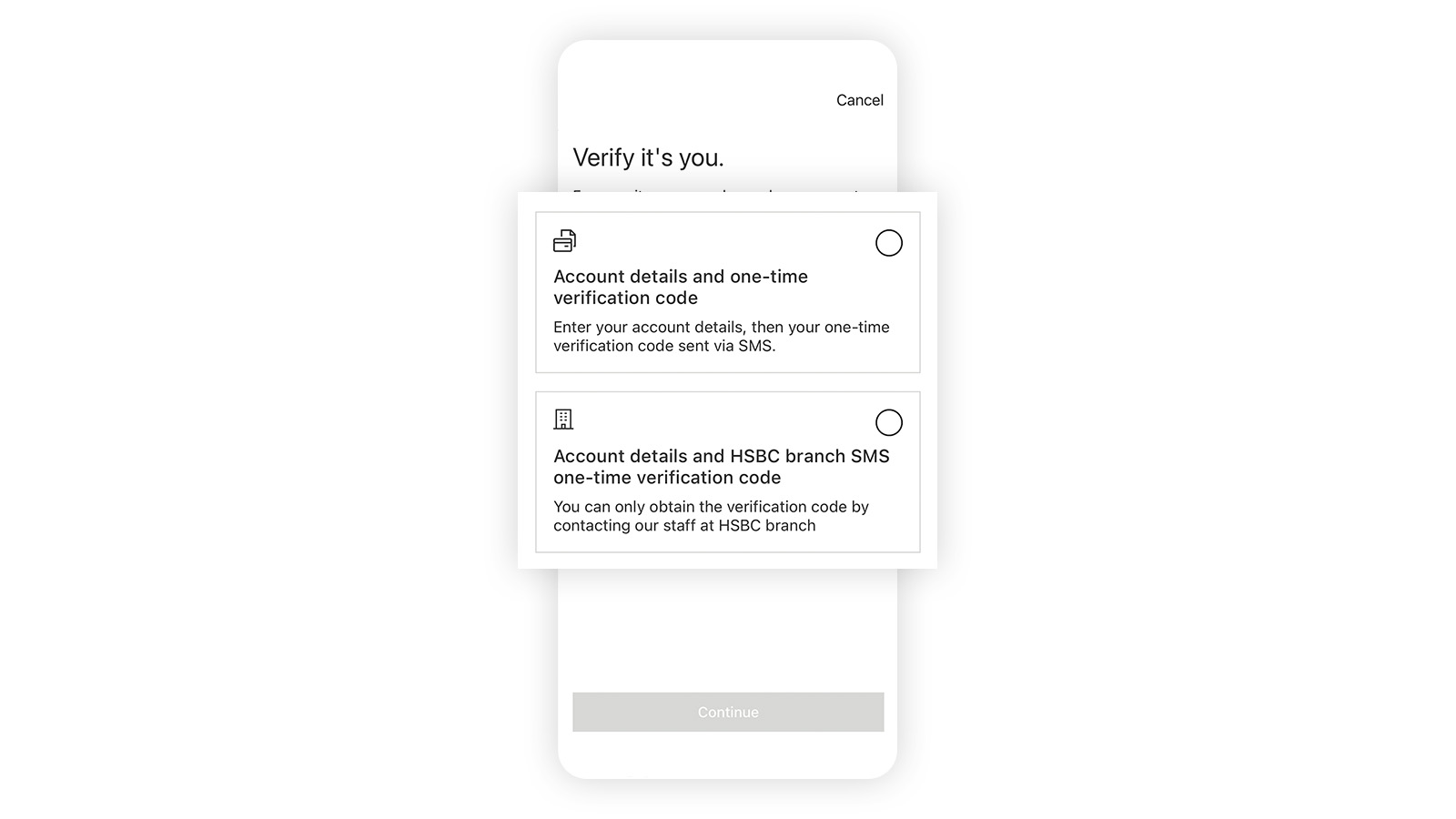

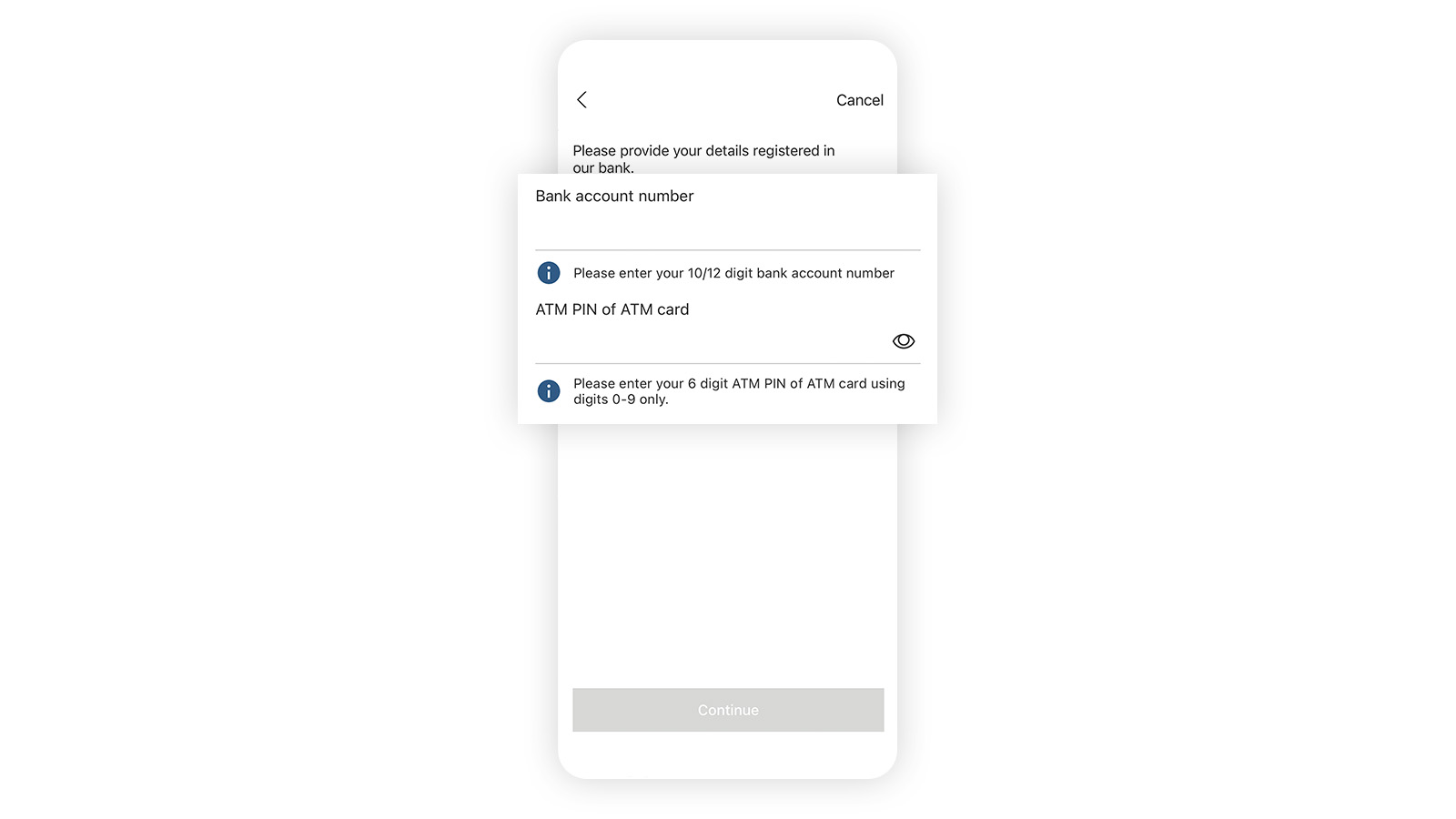

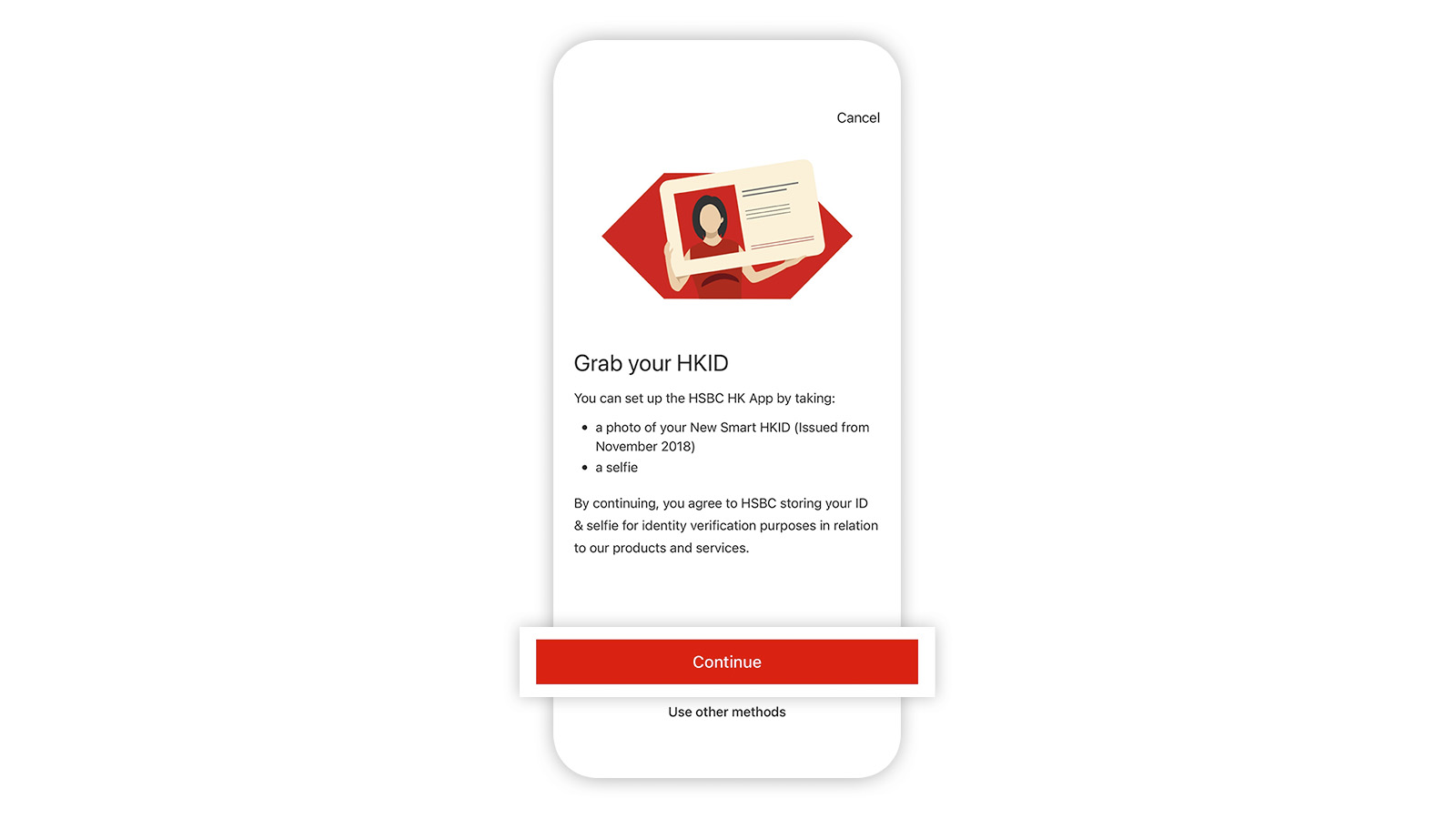

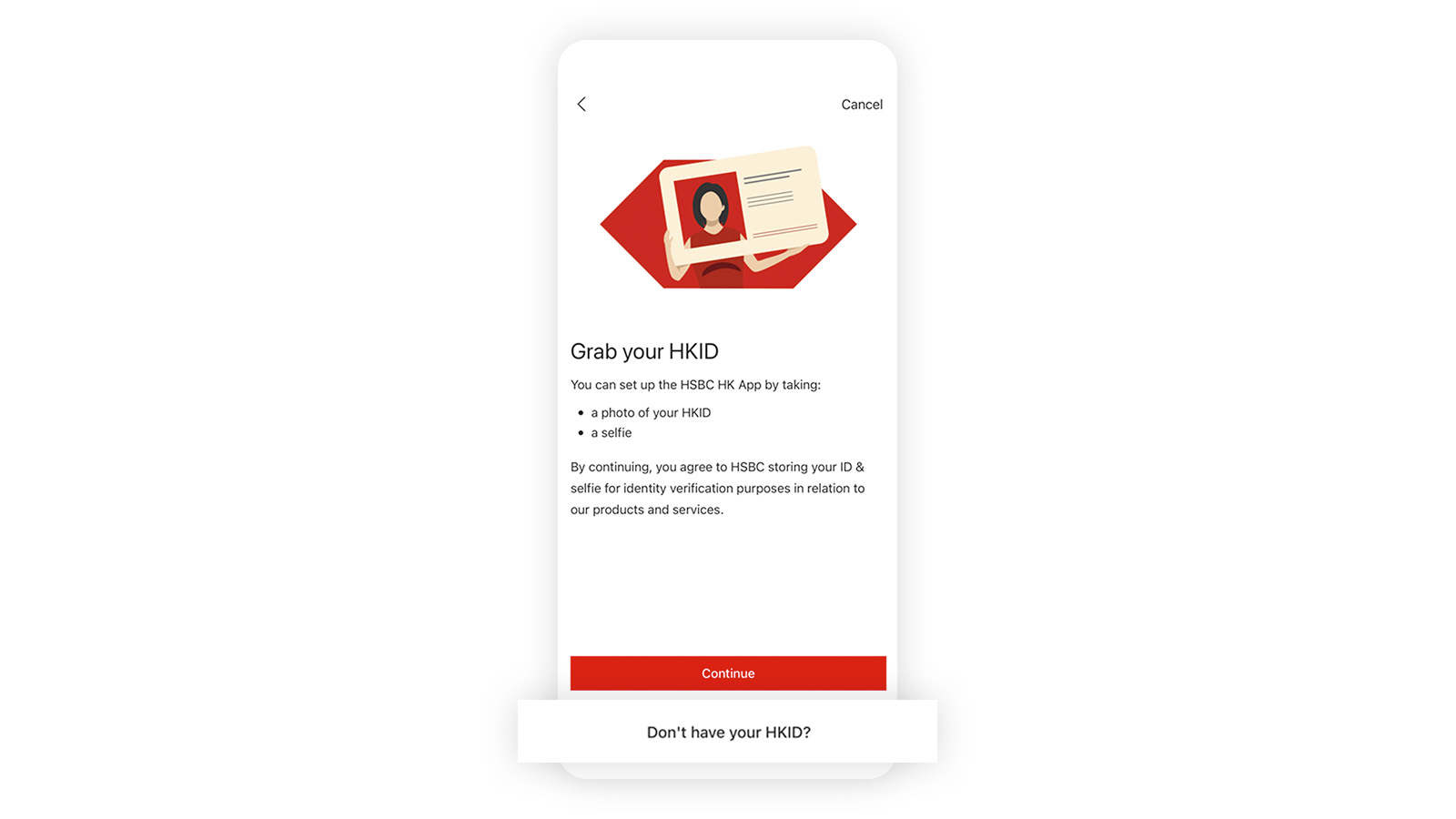

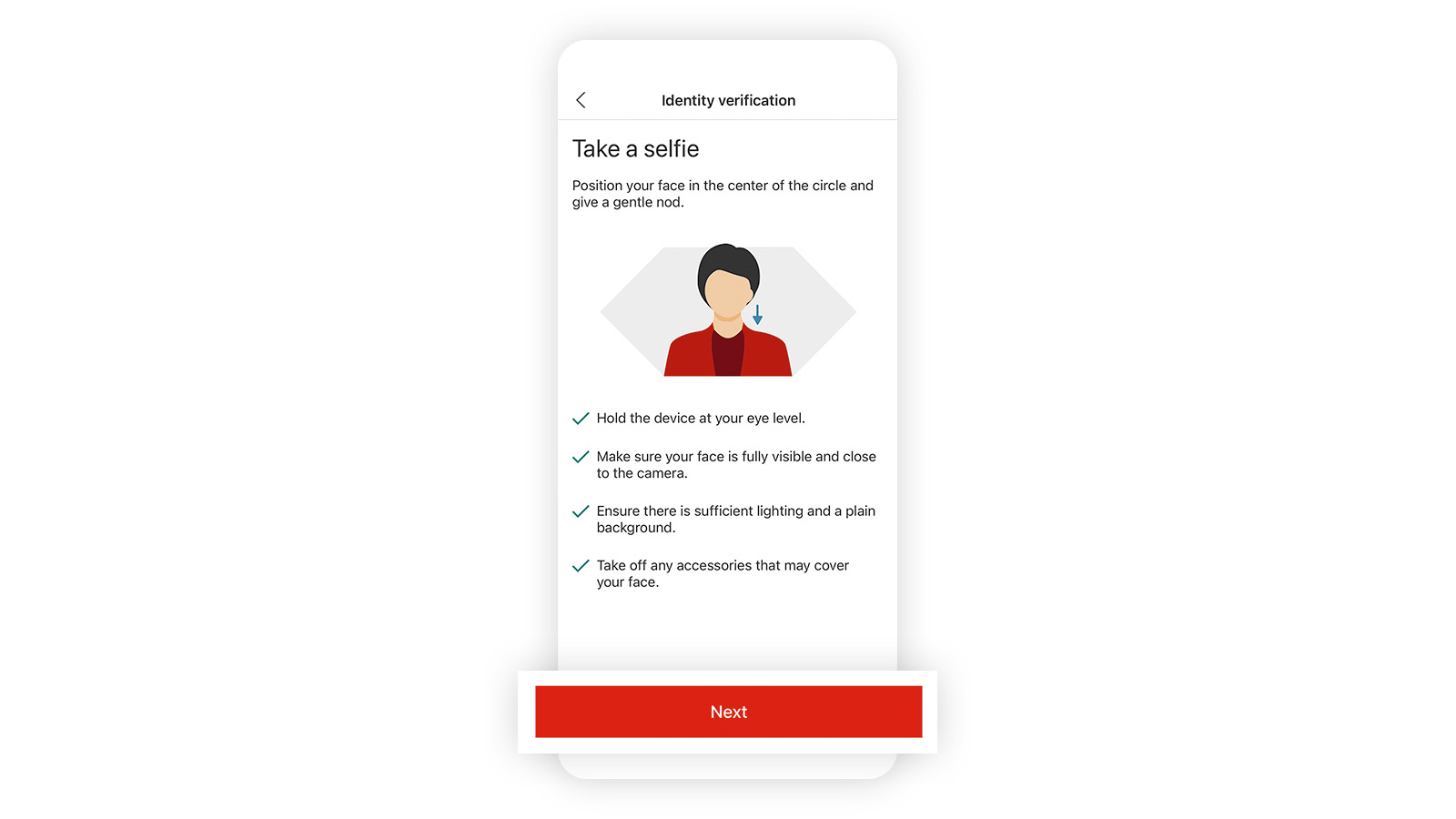

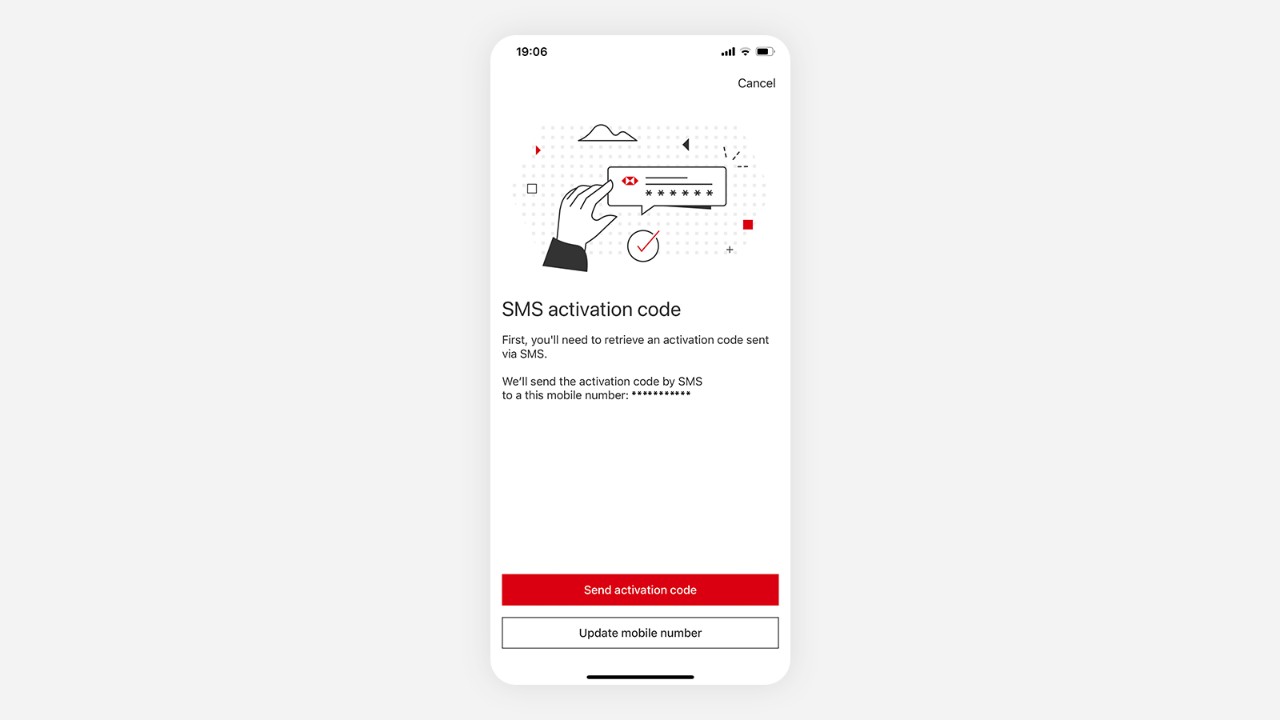

Verifying your identity

To better protect the security of your accounts, you may be asked to verify your identity when required (such as after having activated the Mobile Security Key) to enjoy full access to HSBC Digital Banking services.

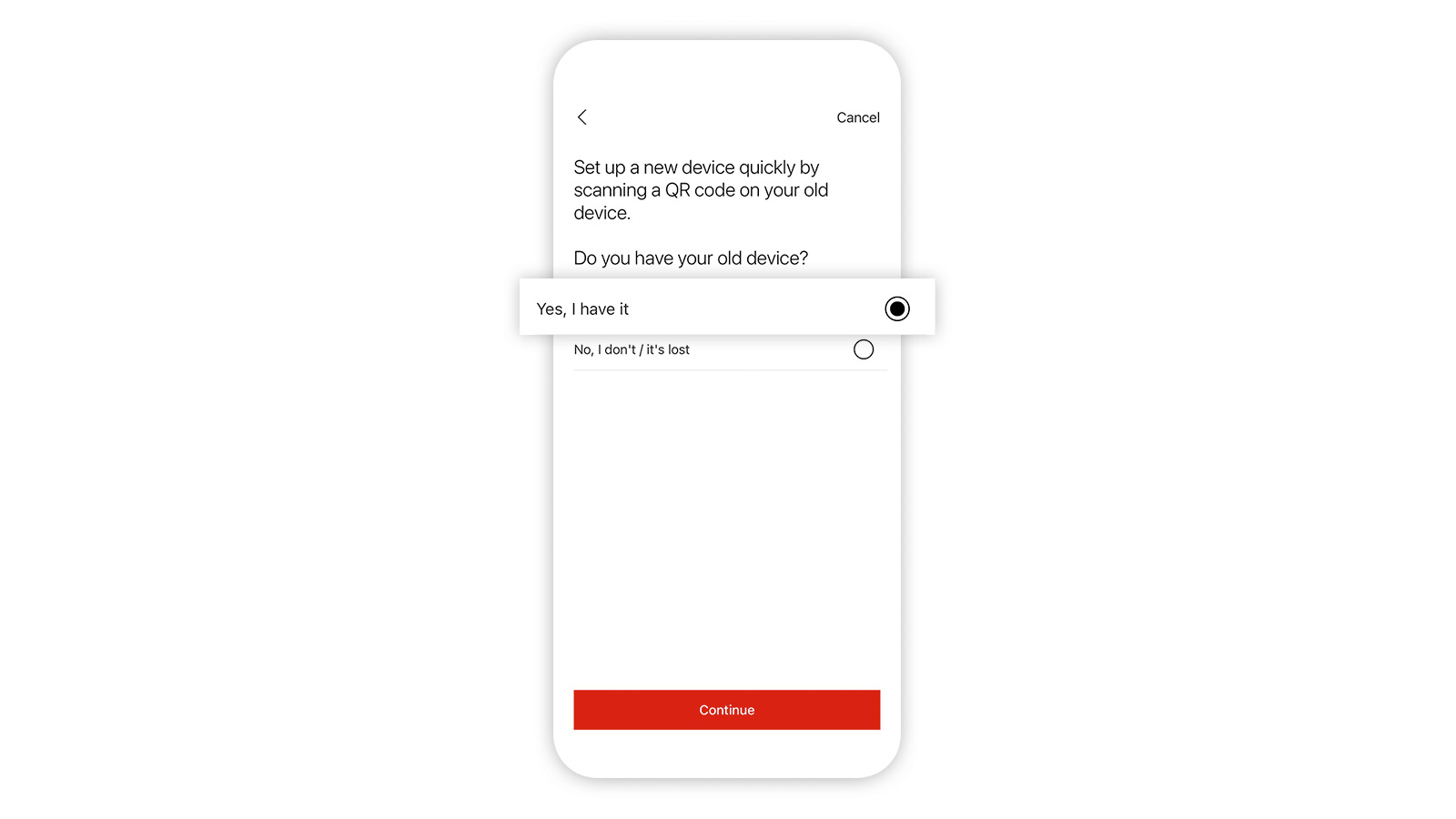

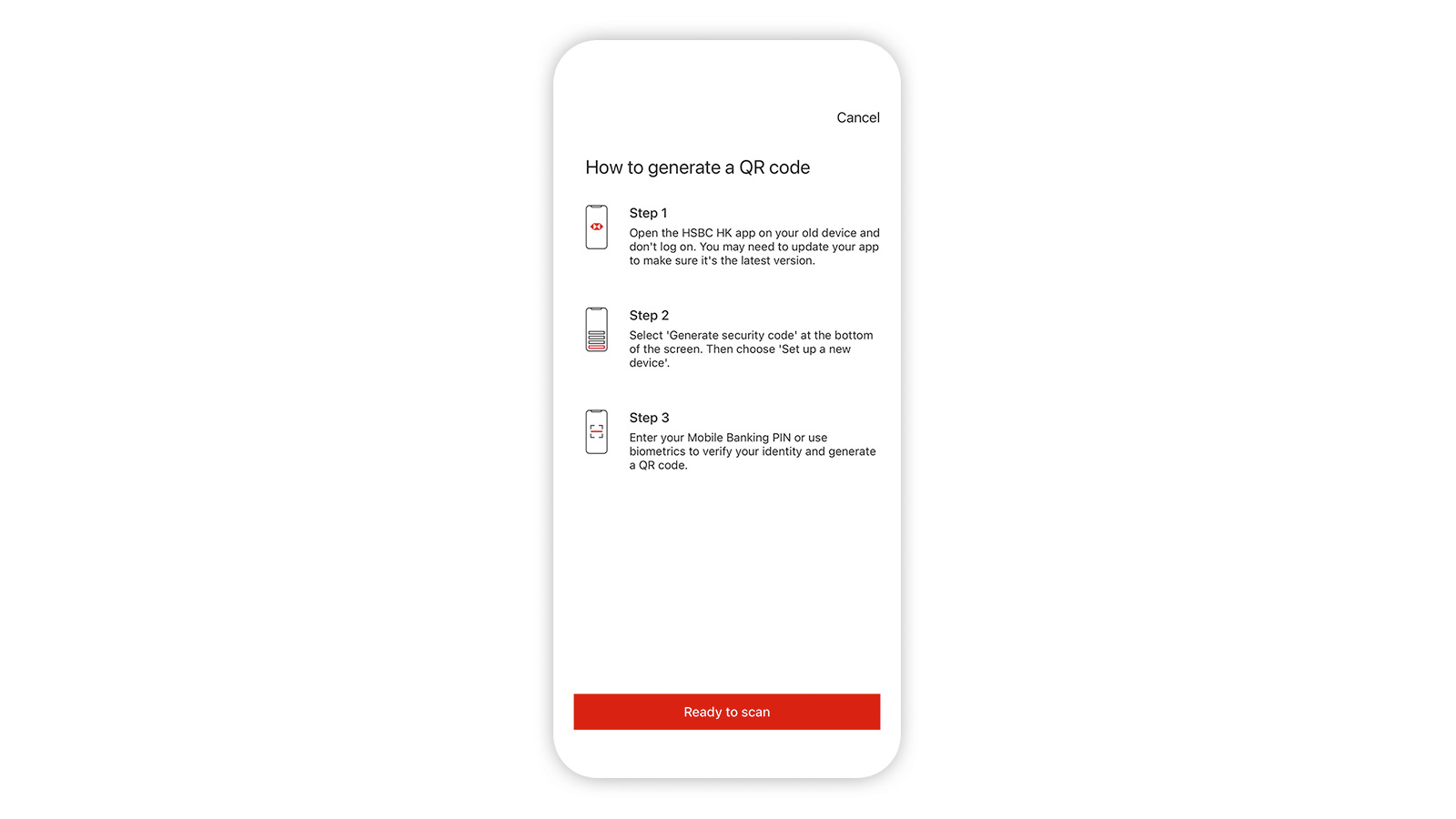

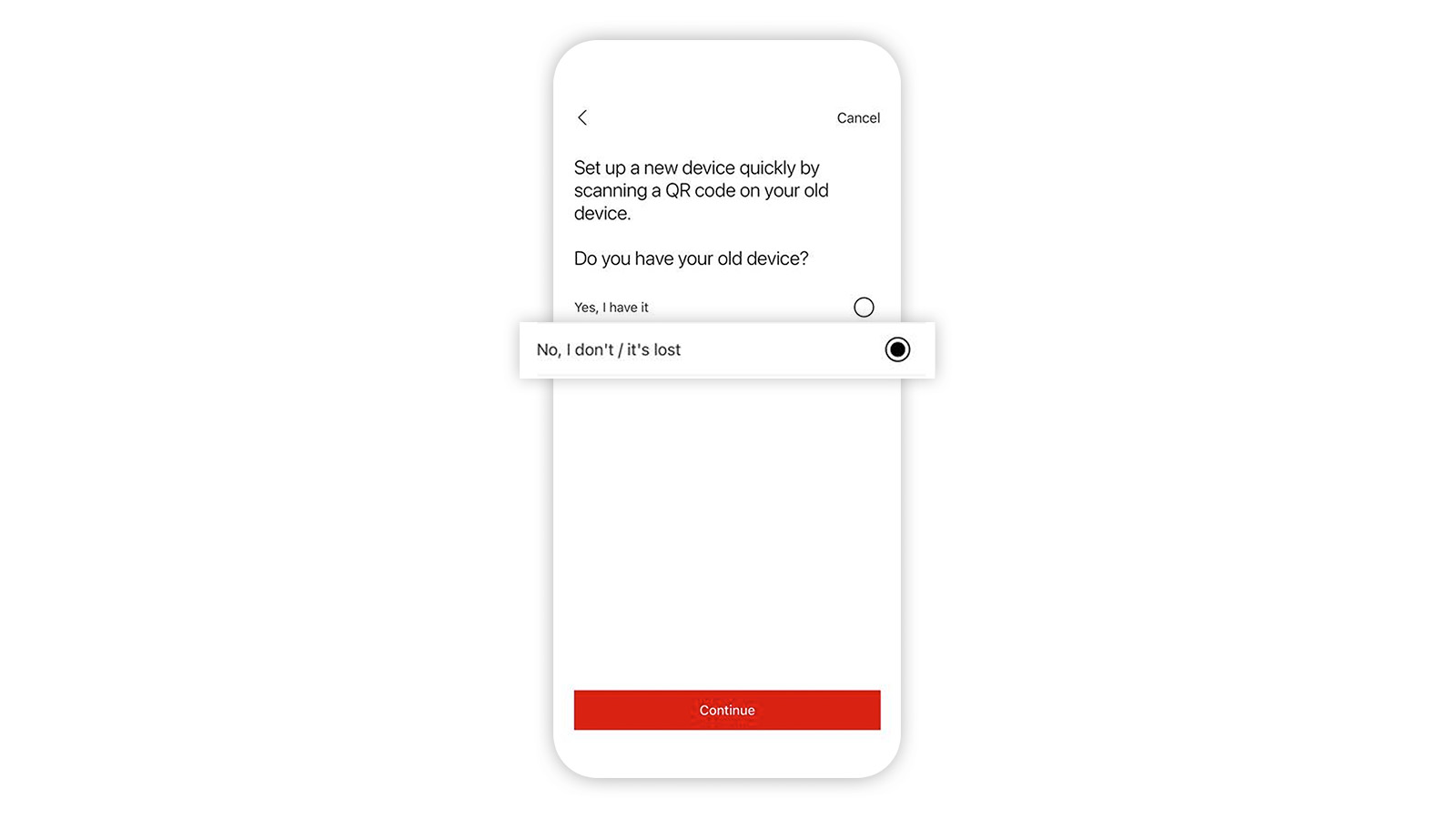

Switch device

For security reasons, you can only set up the HSBC HK App on one device. If you want to use a new device to log on to the app, please follow below steps to switch your device.

Please note, after setting up the HSBC HK App, you may need to further verify your identity before you can enjoy full access to HSBC Online and Mobile Banking services.

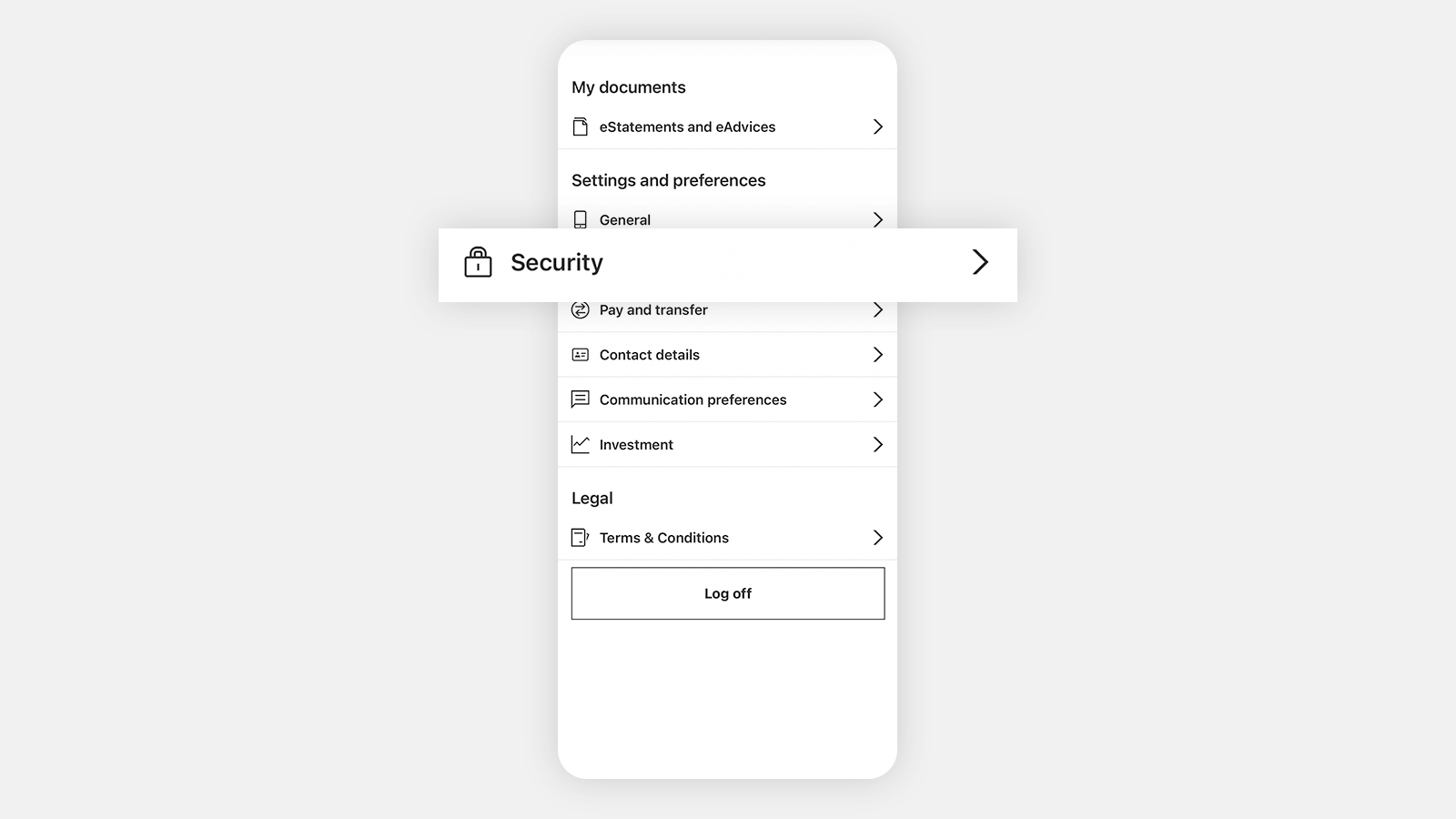

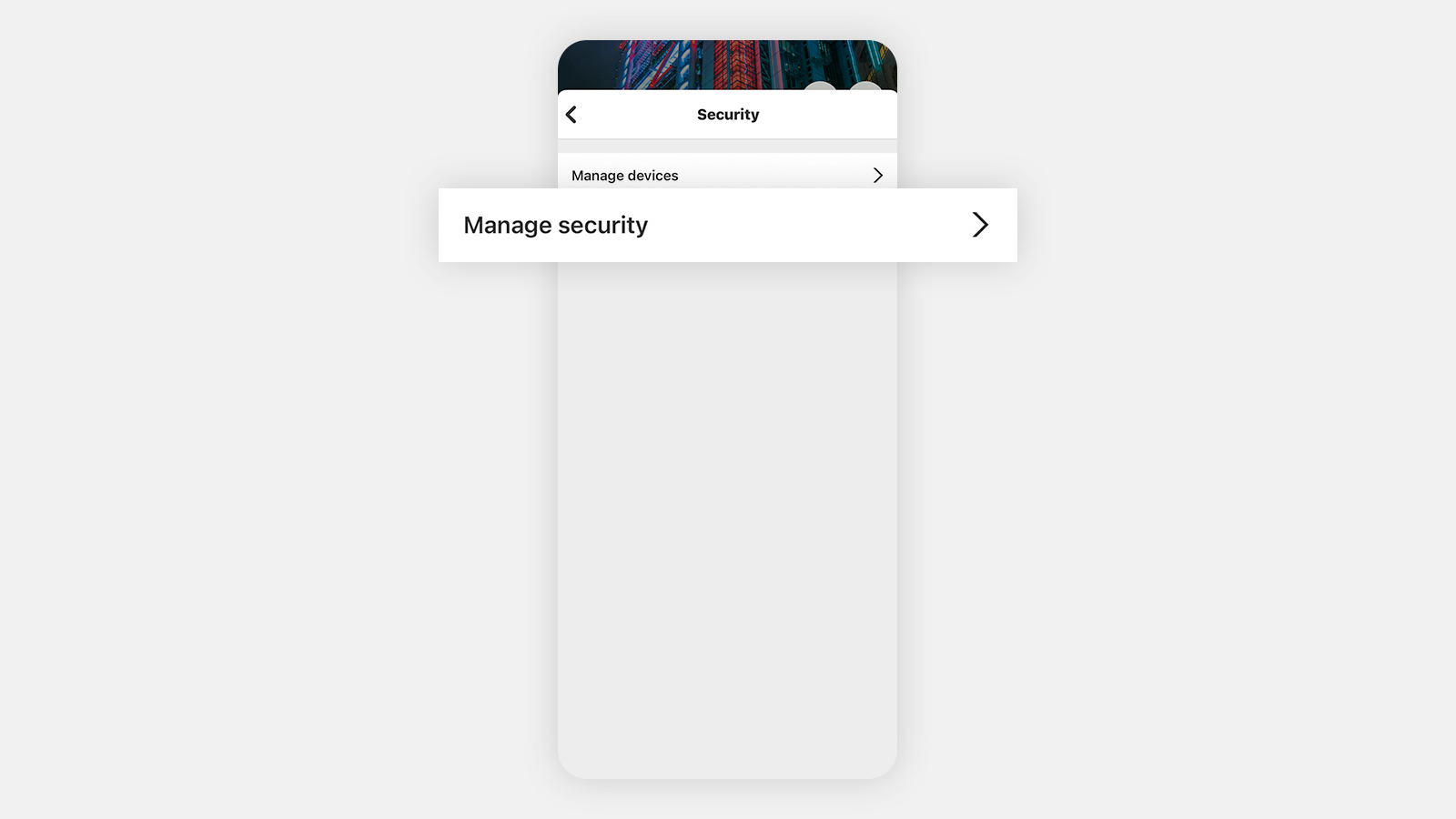

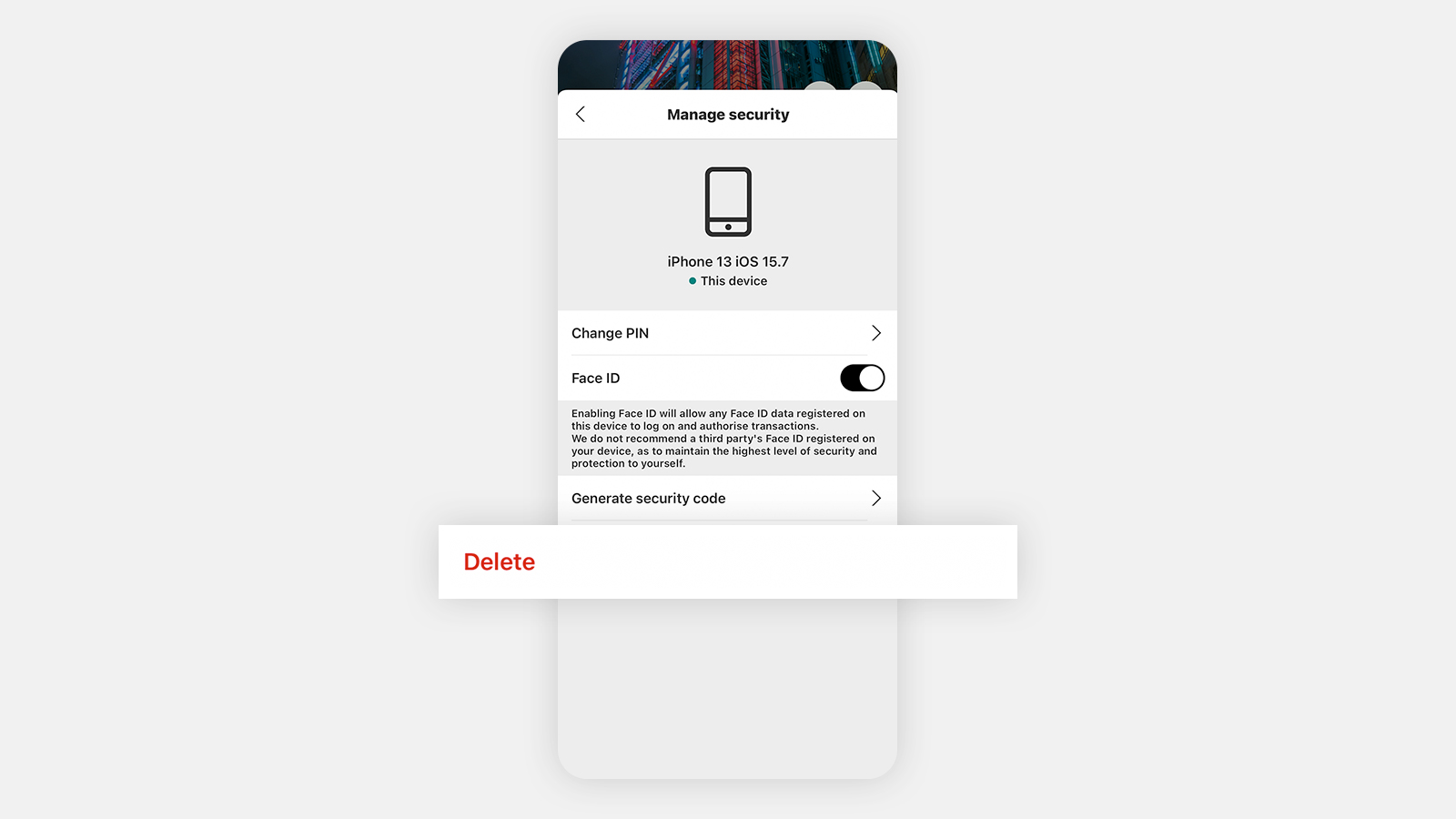

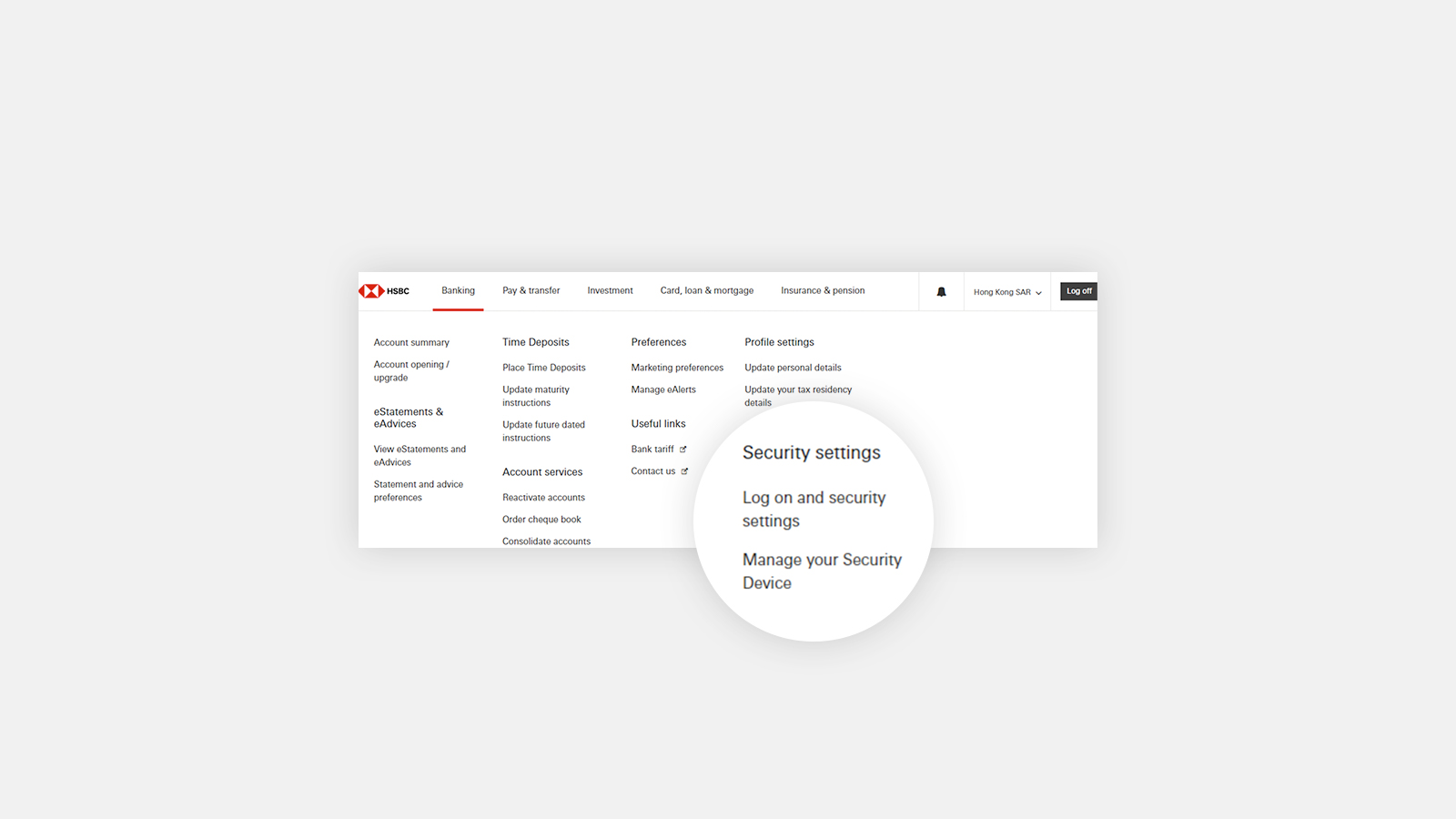

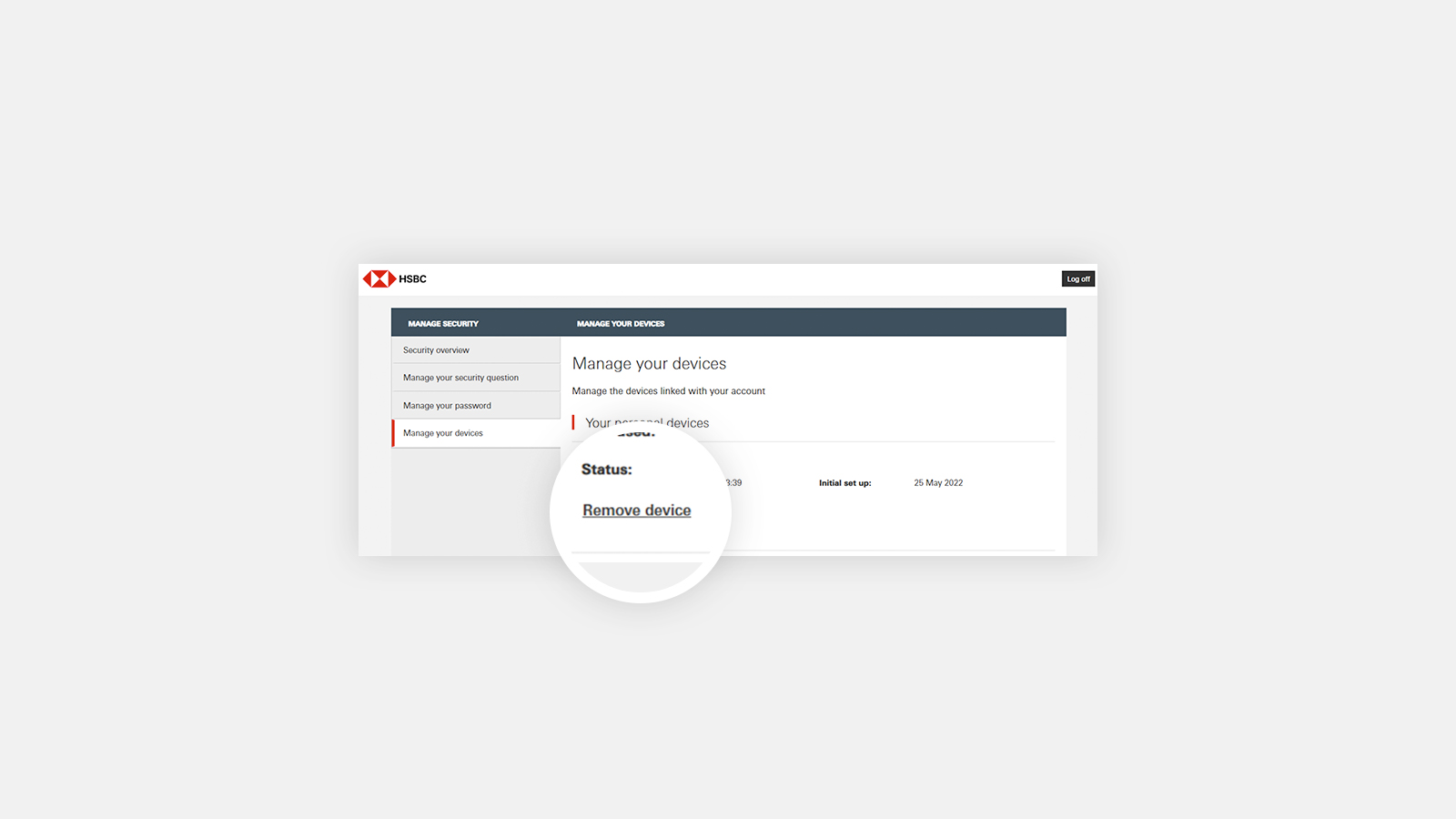

Manage device

For security reasons, you can only set up the HSBC HK App on one device. If you no longer need the app on your device, you may remove linked devices on the HSBC HK App or Online Banking.

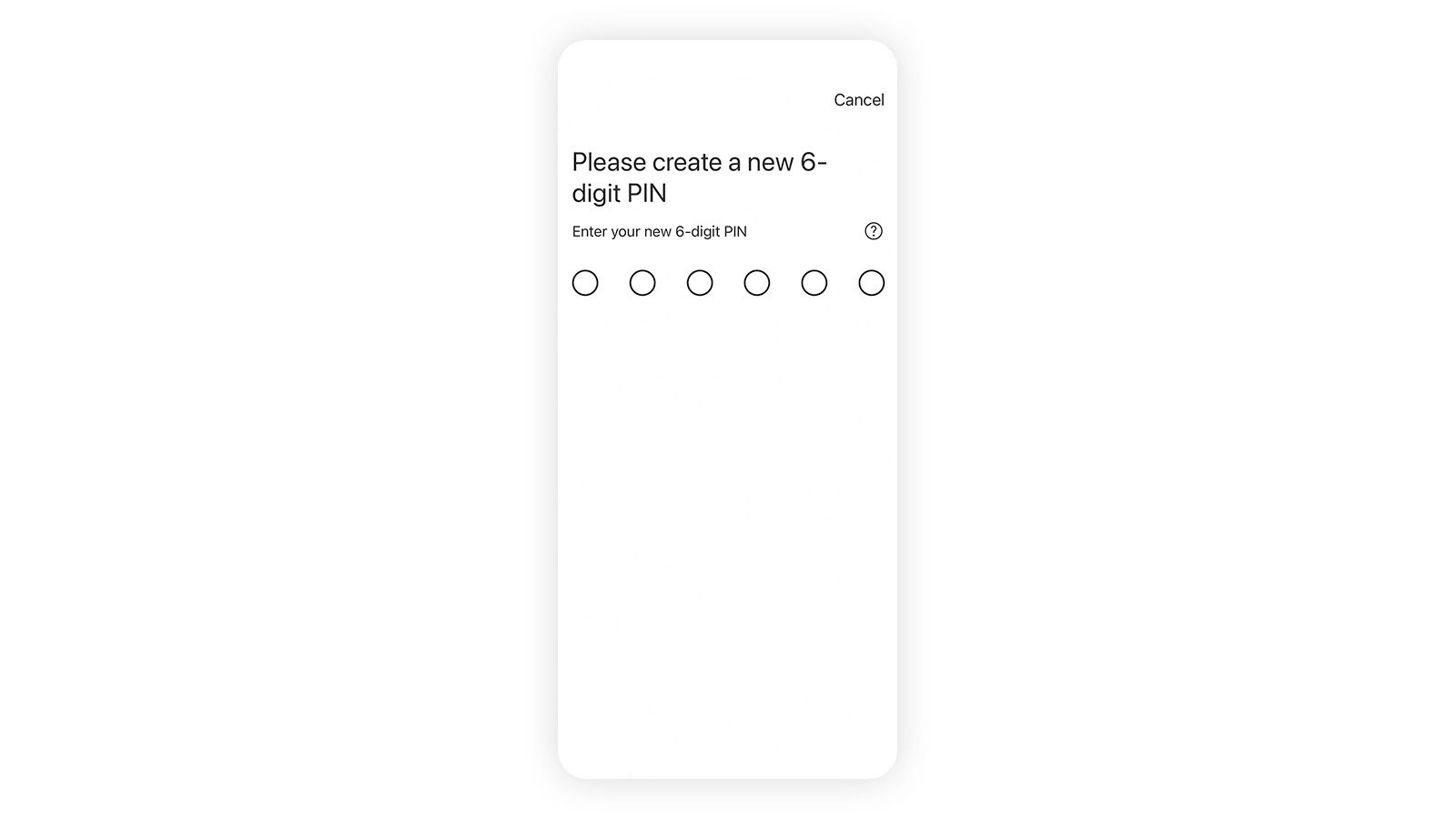

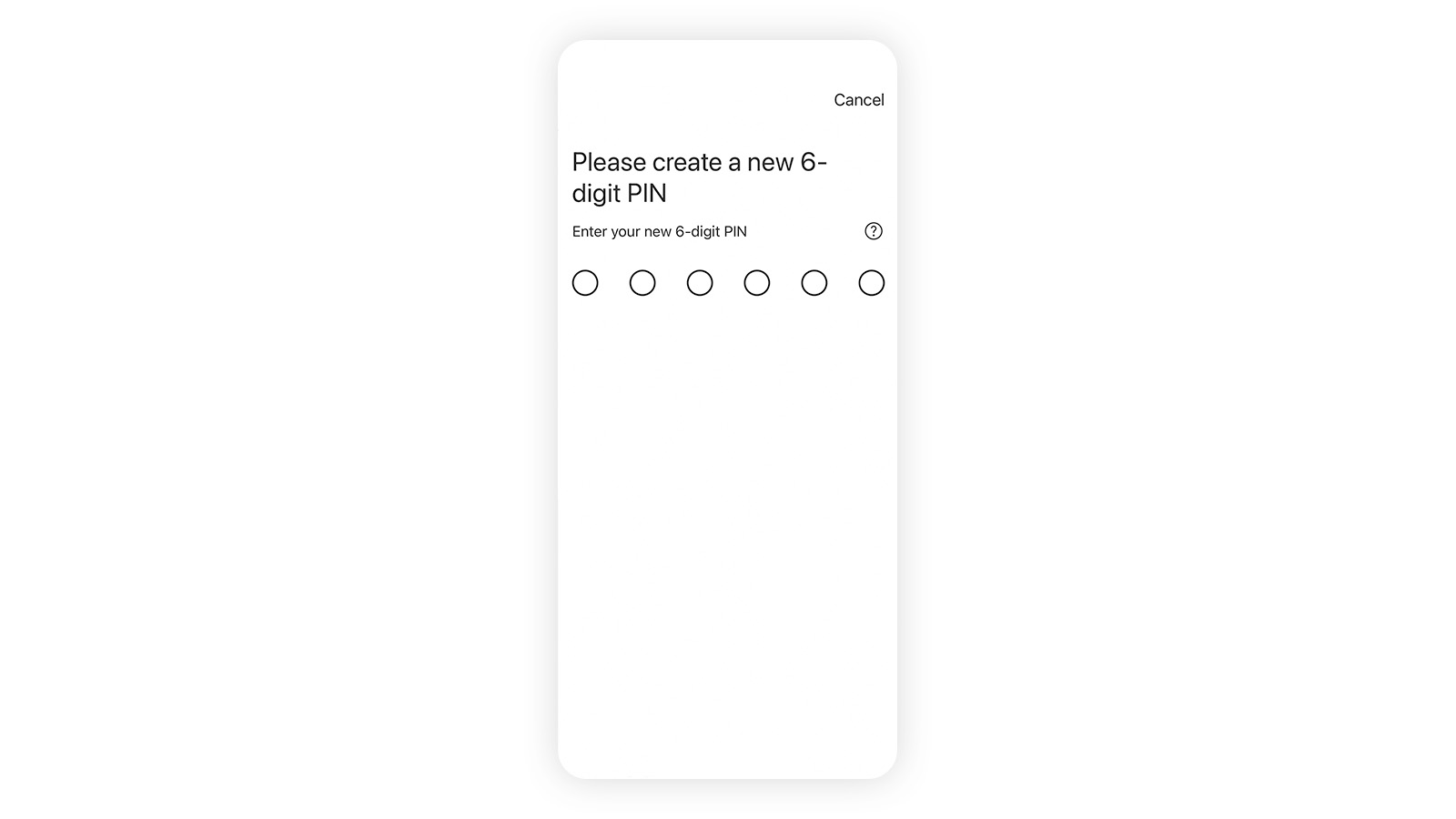

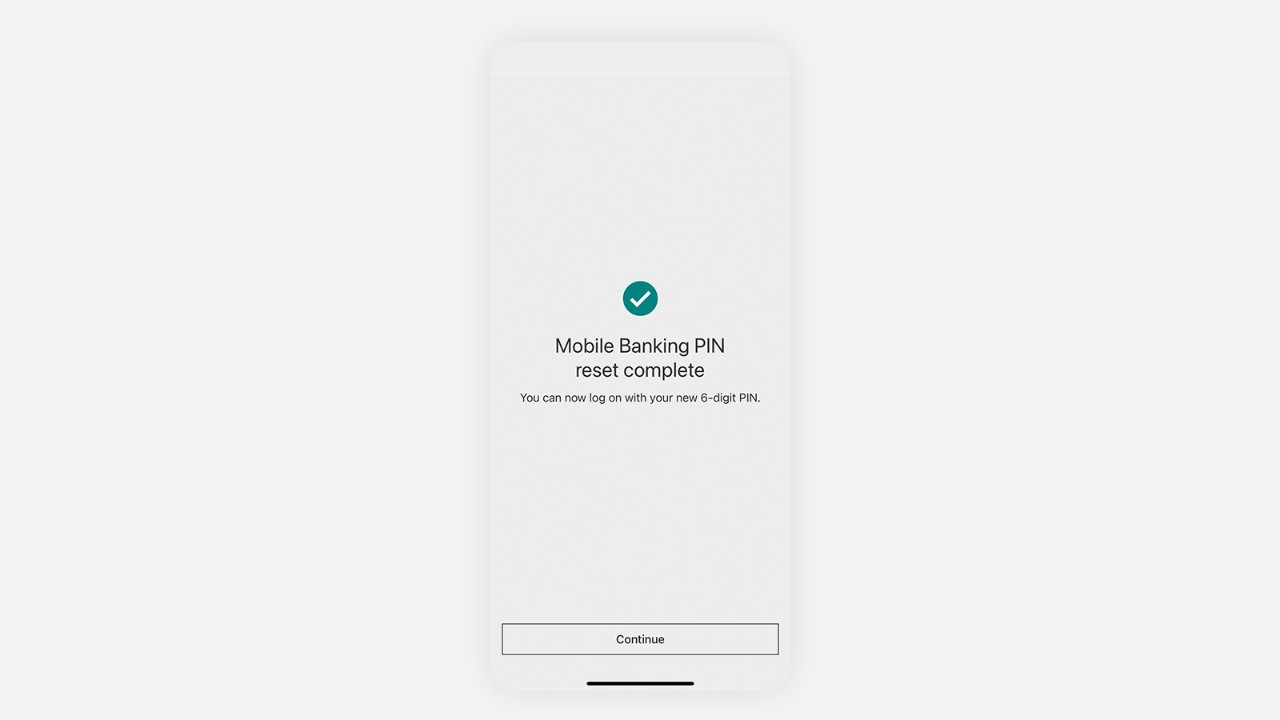

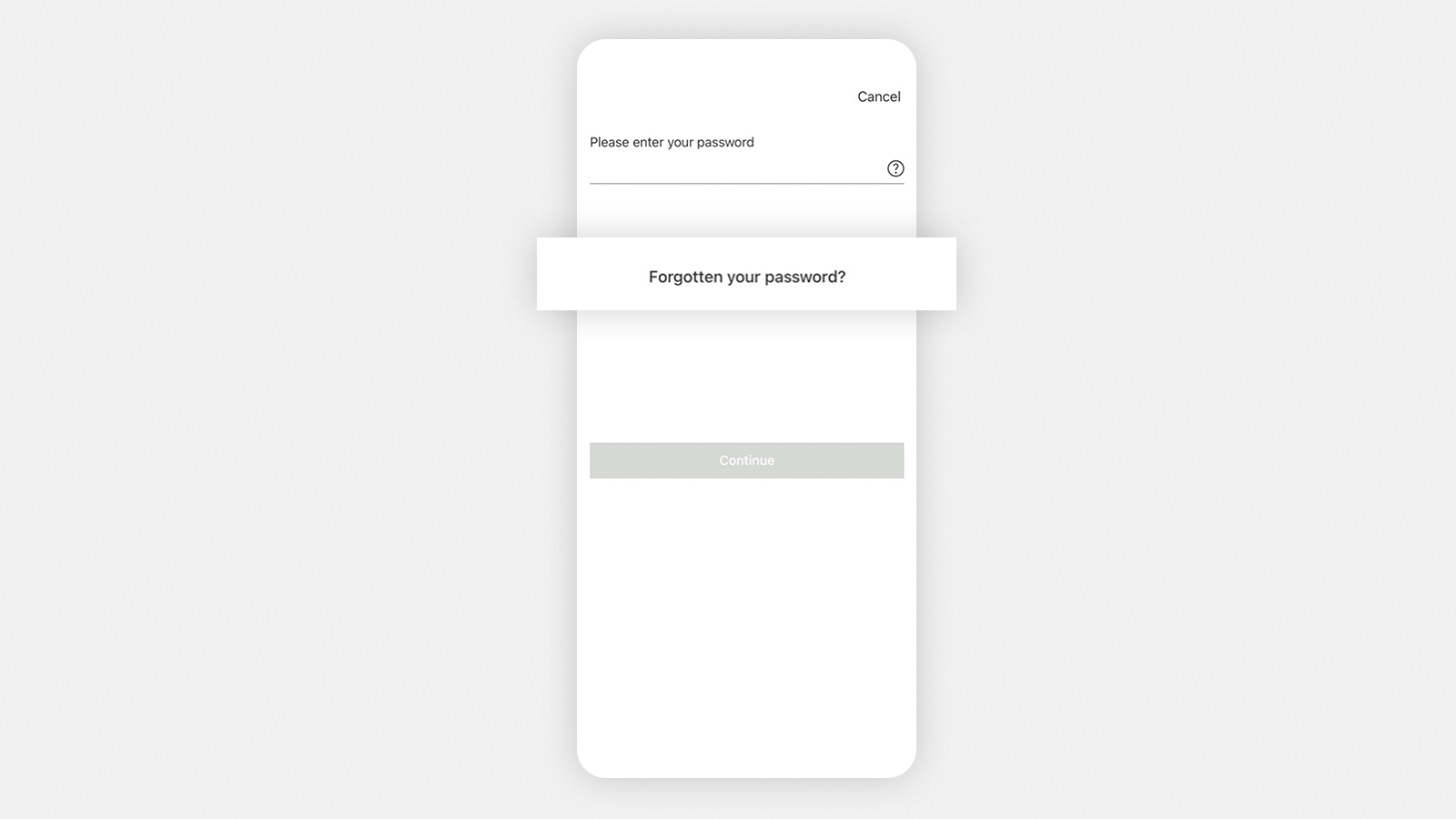

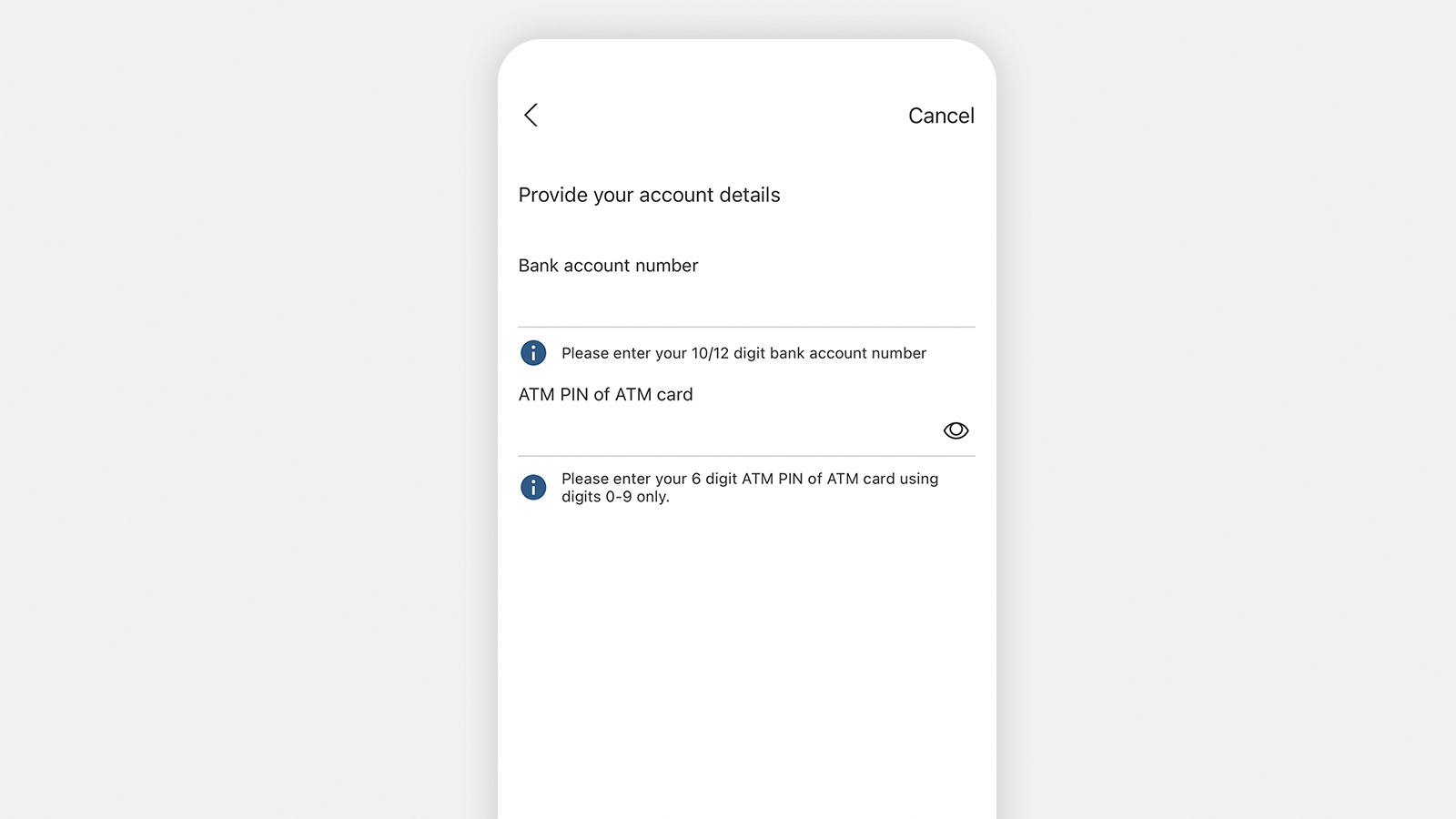

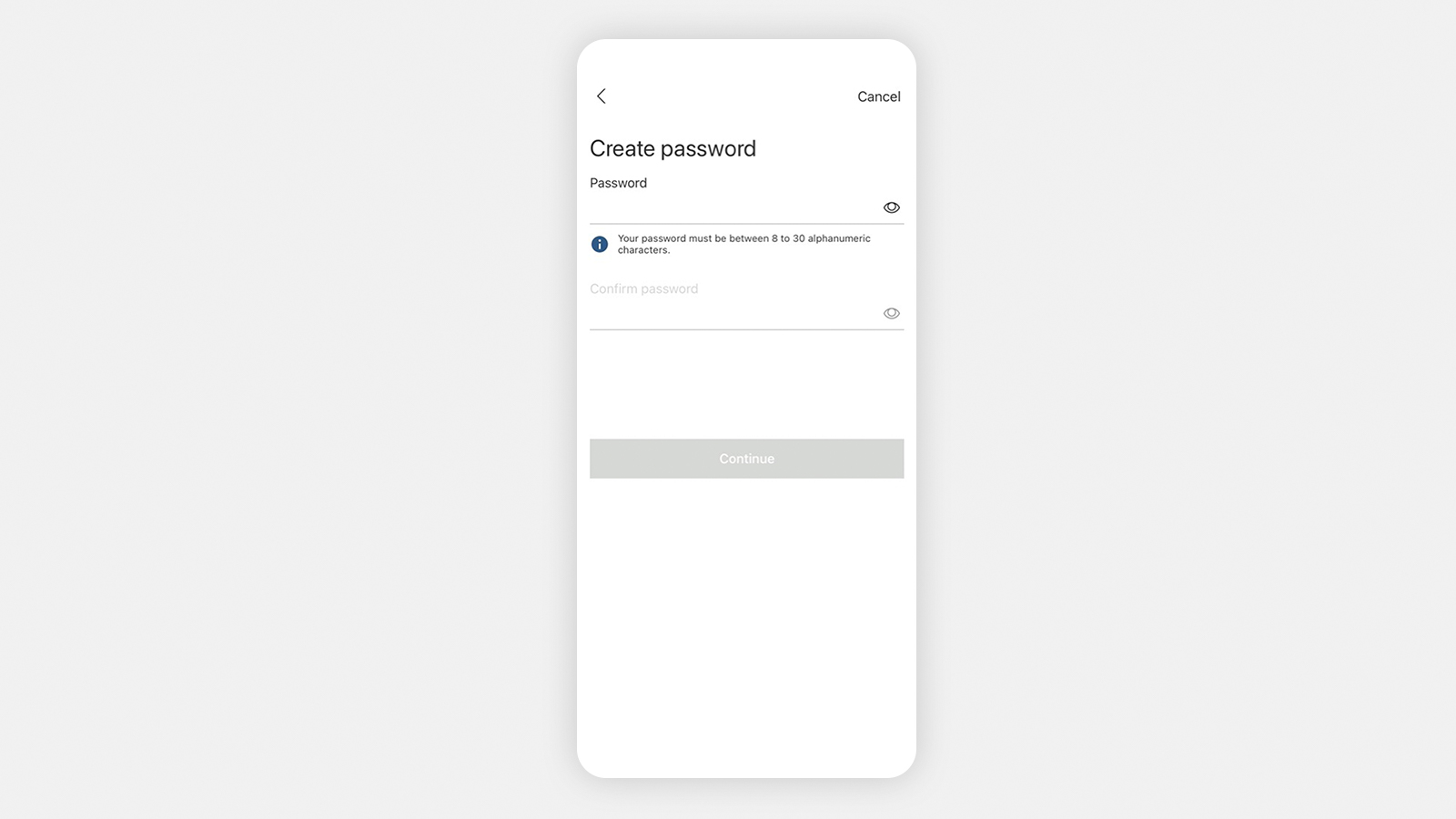

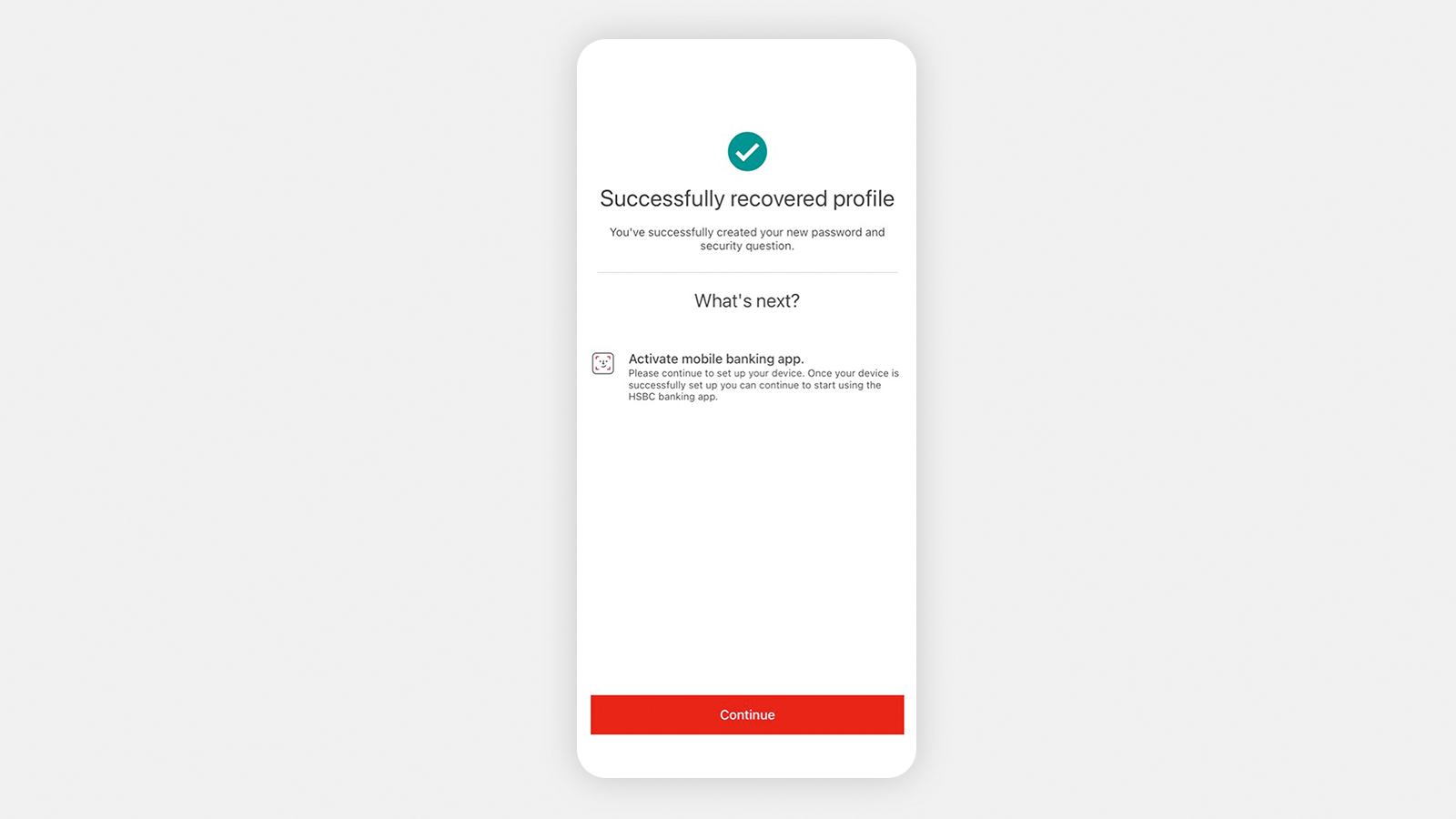

Reset 'Mobile Banking PIN' / password

What should I do if I have forgotten my logon credentials for Digital Banking? Do not worry, you may use HSBC HK App or Online Banking to reset them easily.

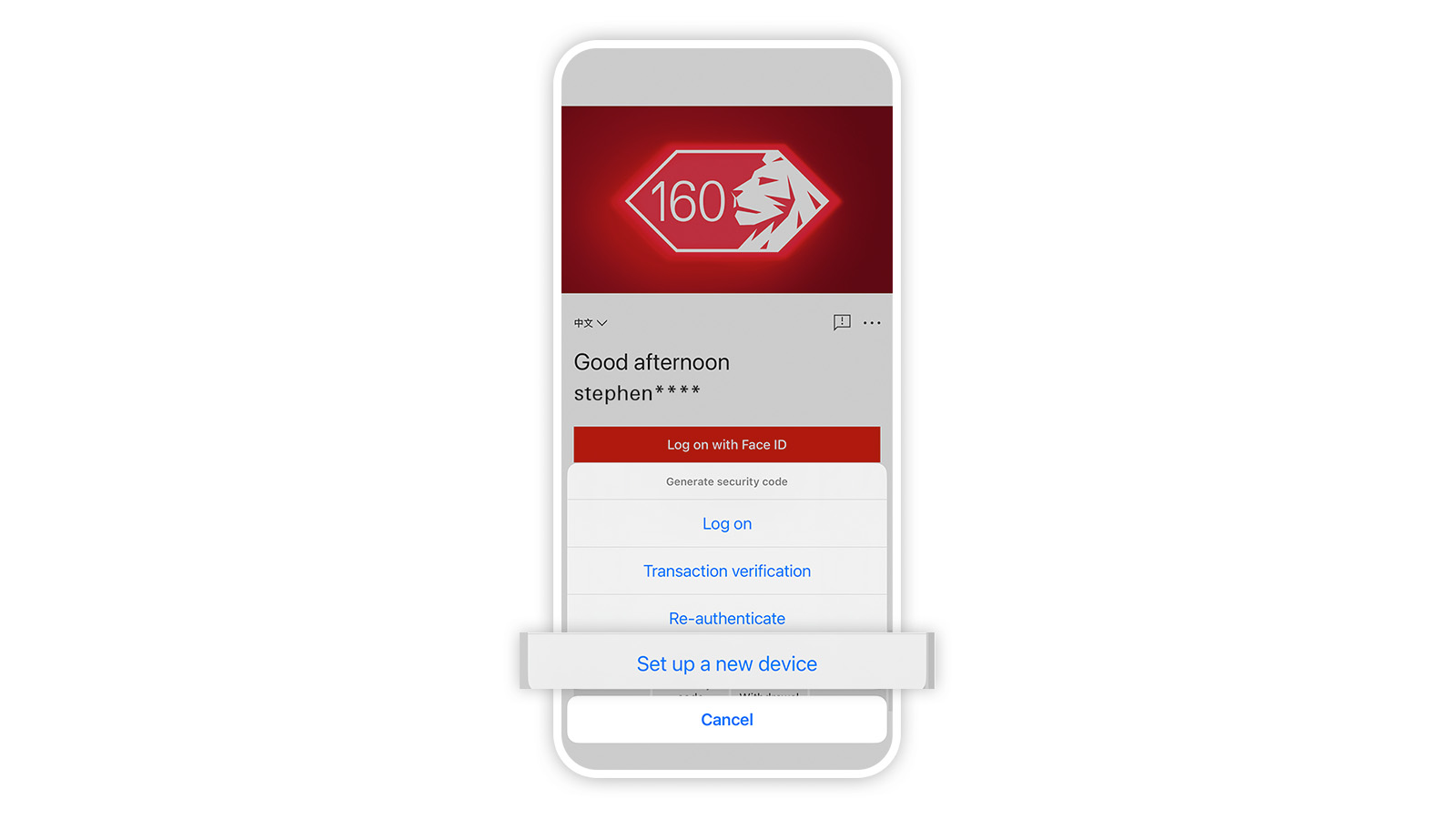

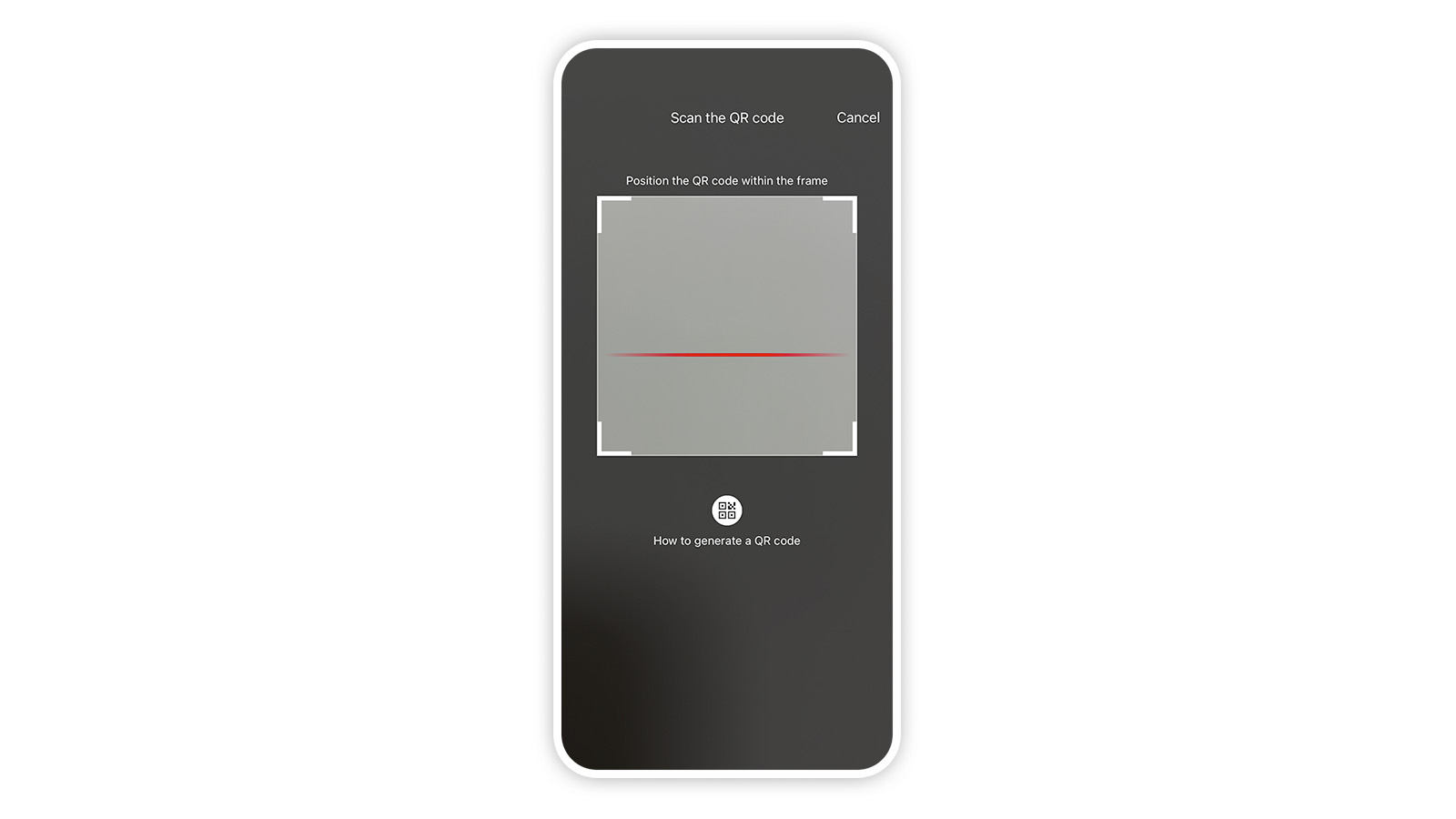

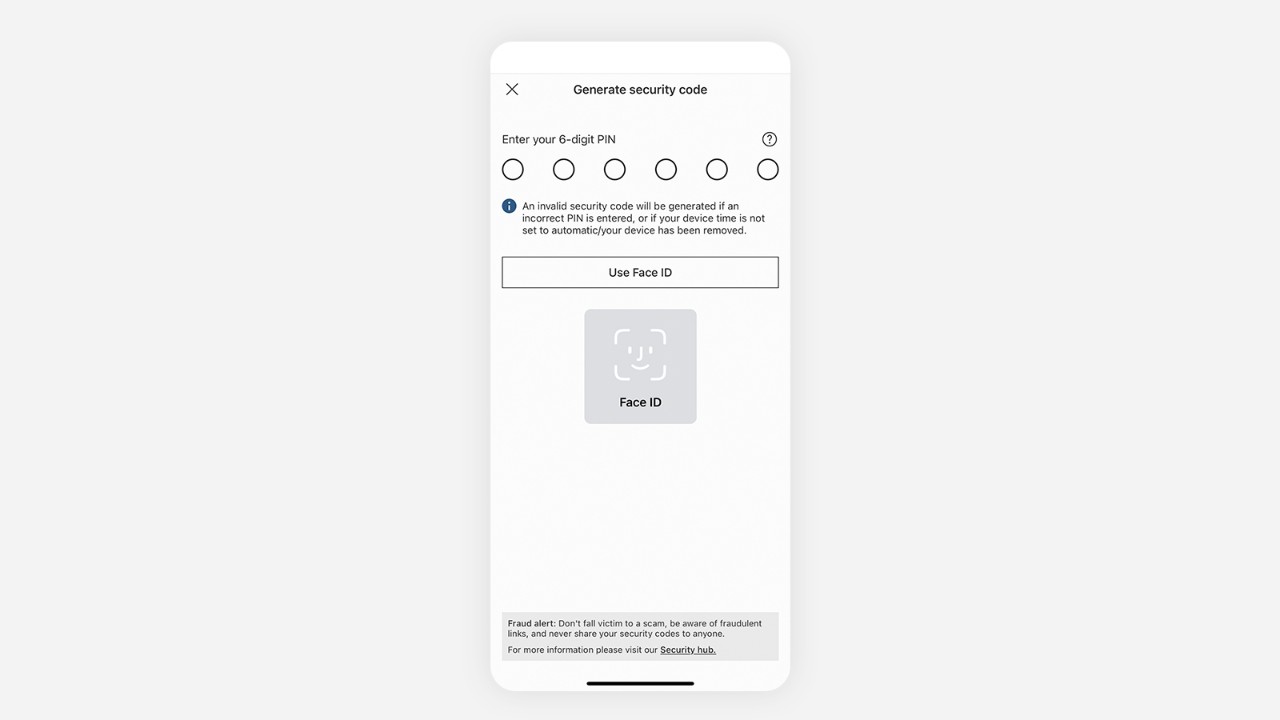

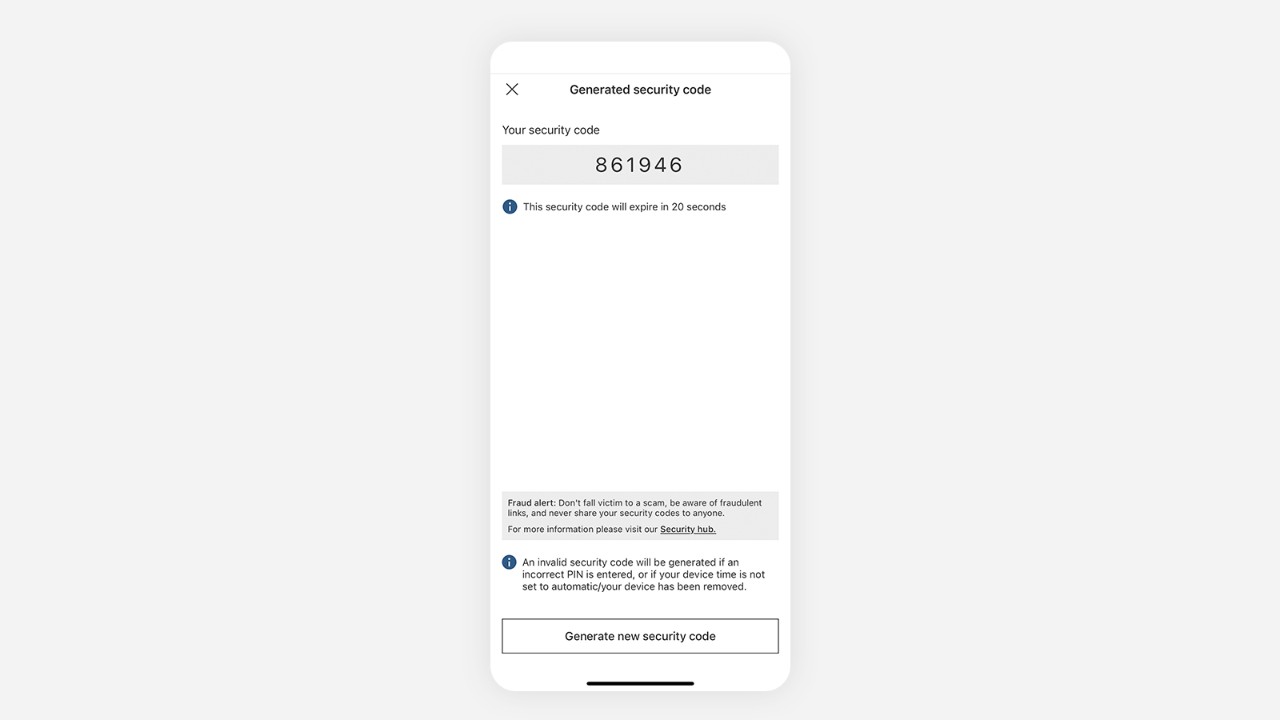

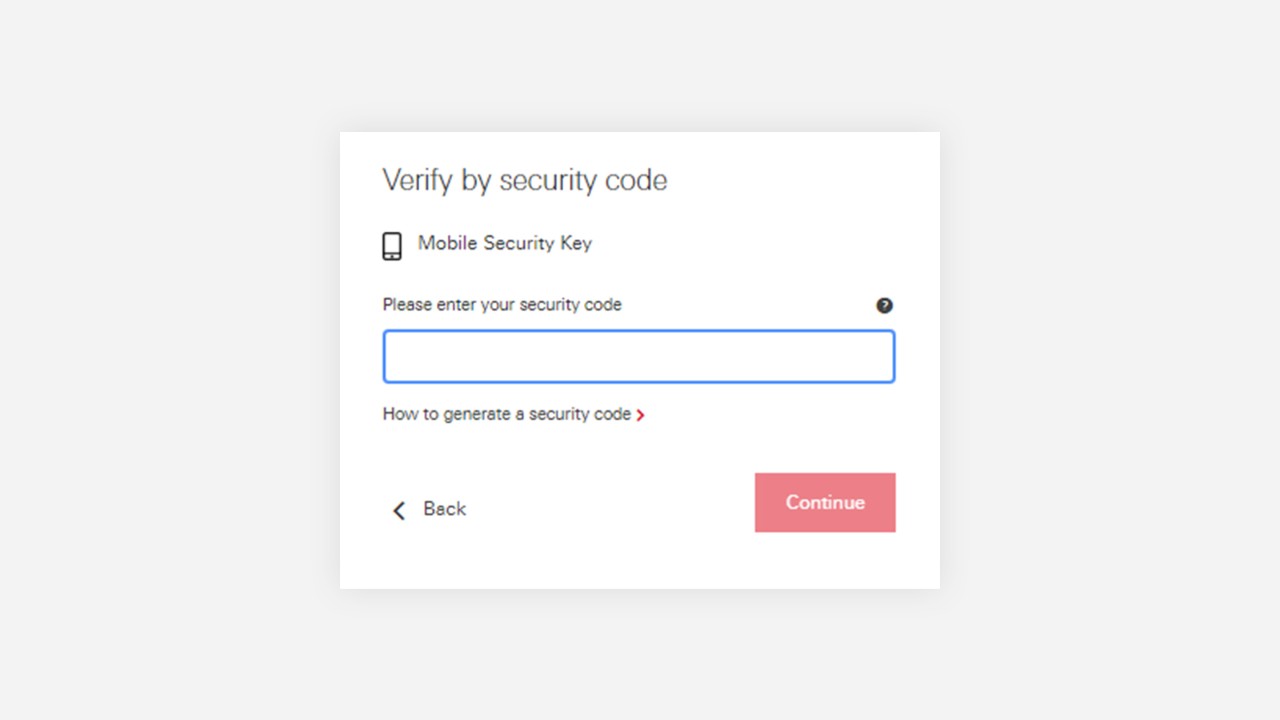

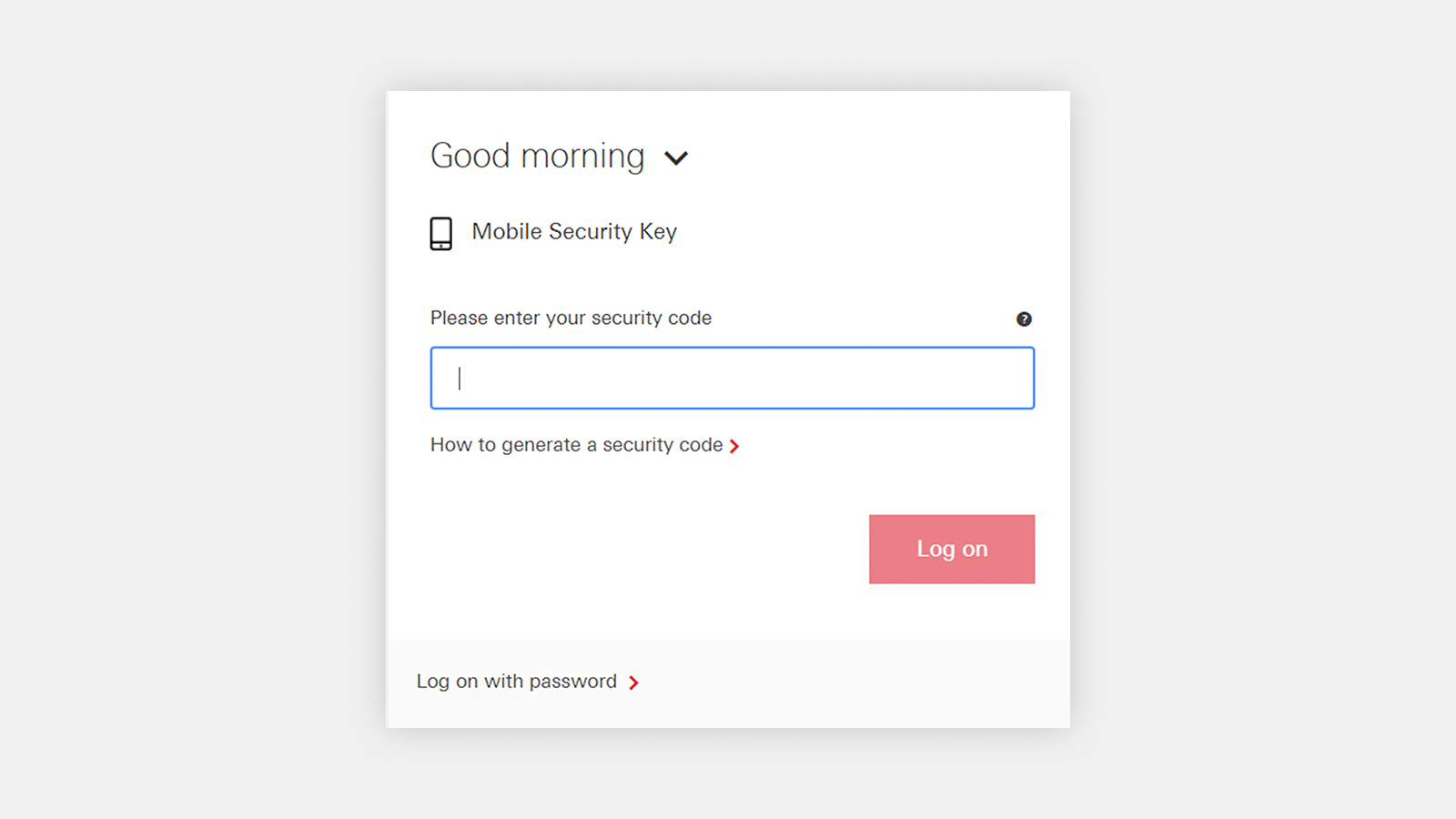

Generate security code from the HSBC HK App

After you've set up the HSBC HK App, you may use the Mobile Security Key feature at the bottom of the log-on screen right away to generate a security code to log on to HSBC Online Banking, verify your online transaction or re-authenticate.

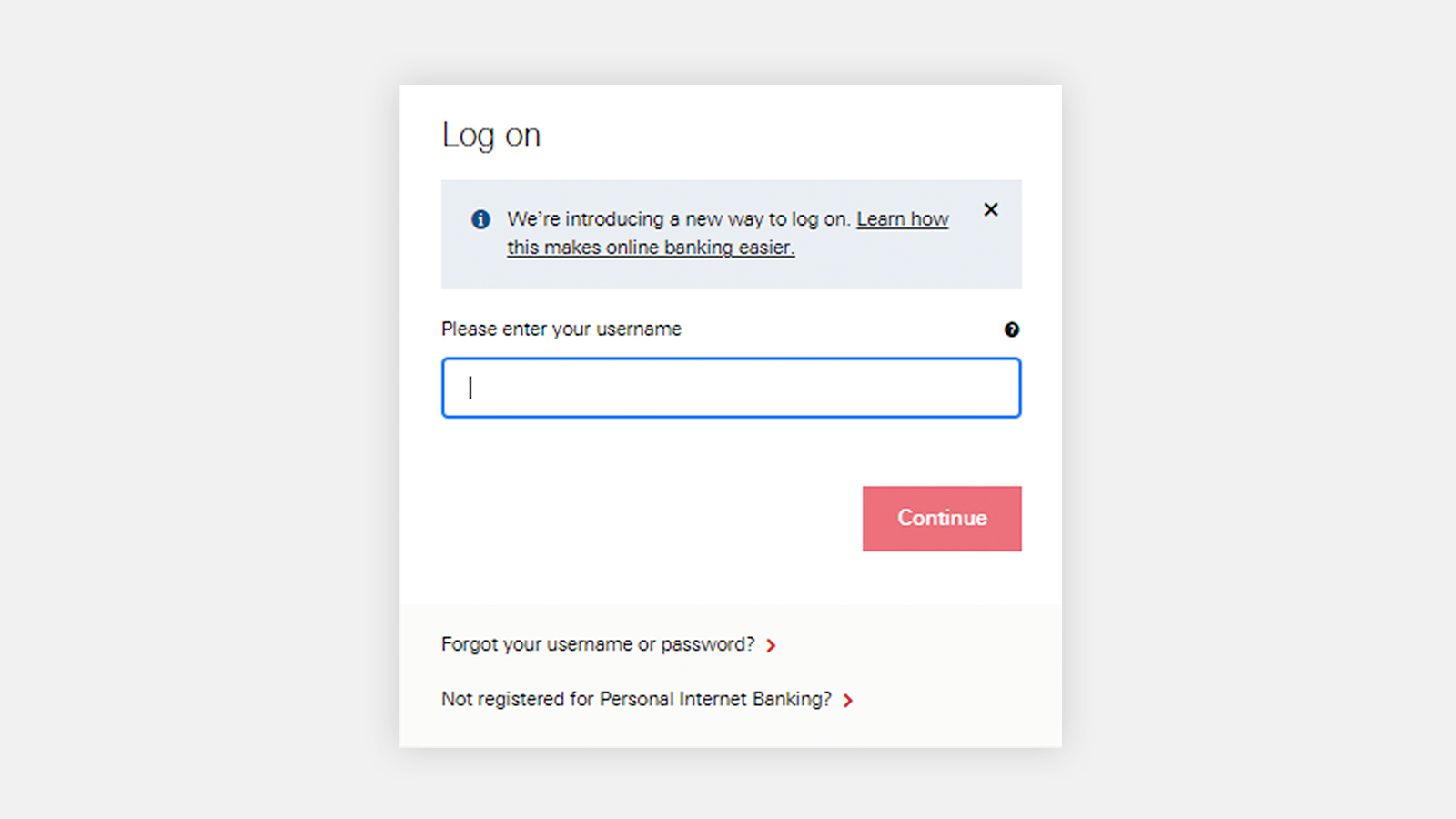

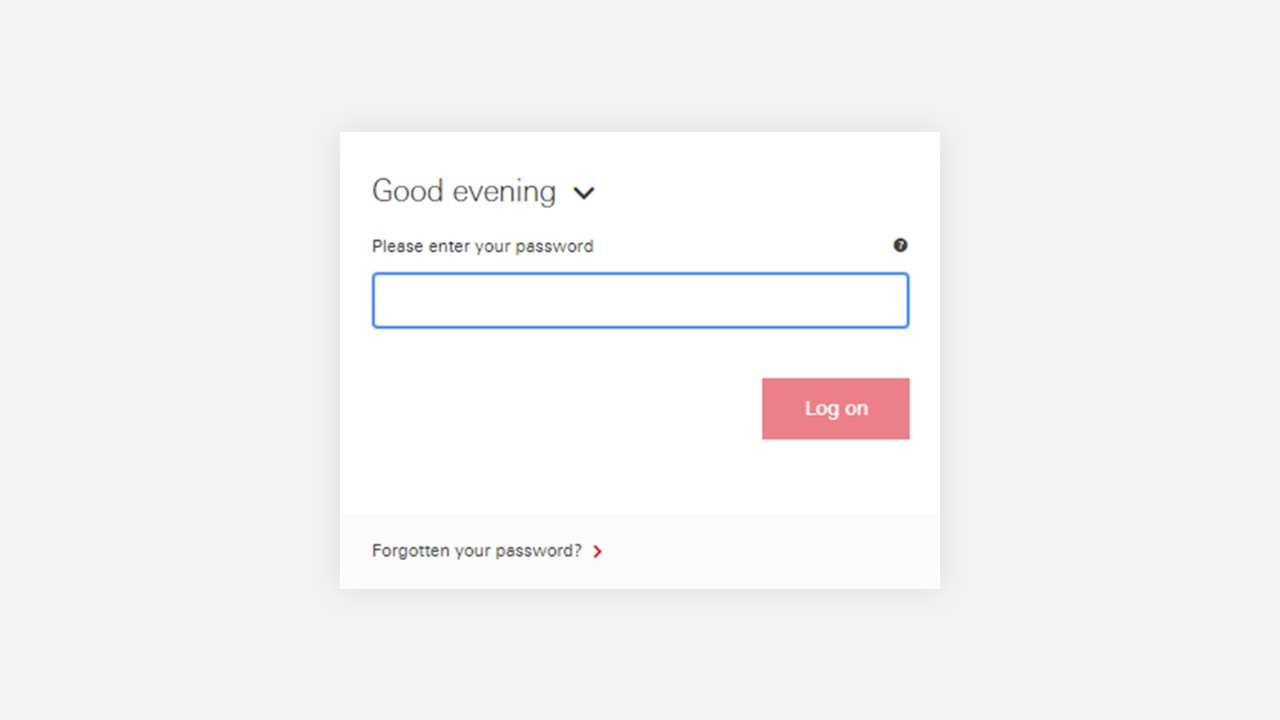

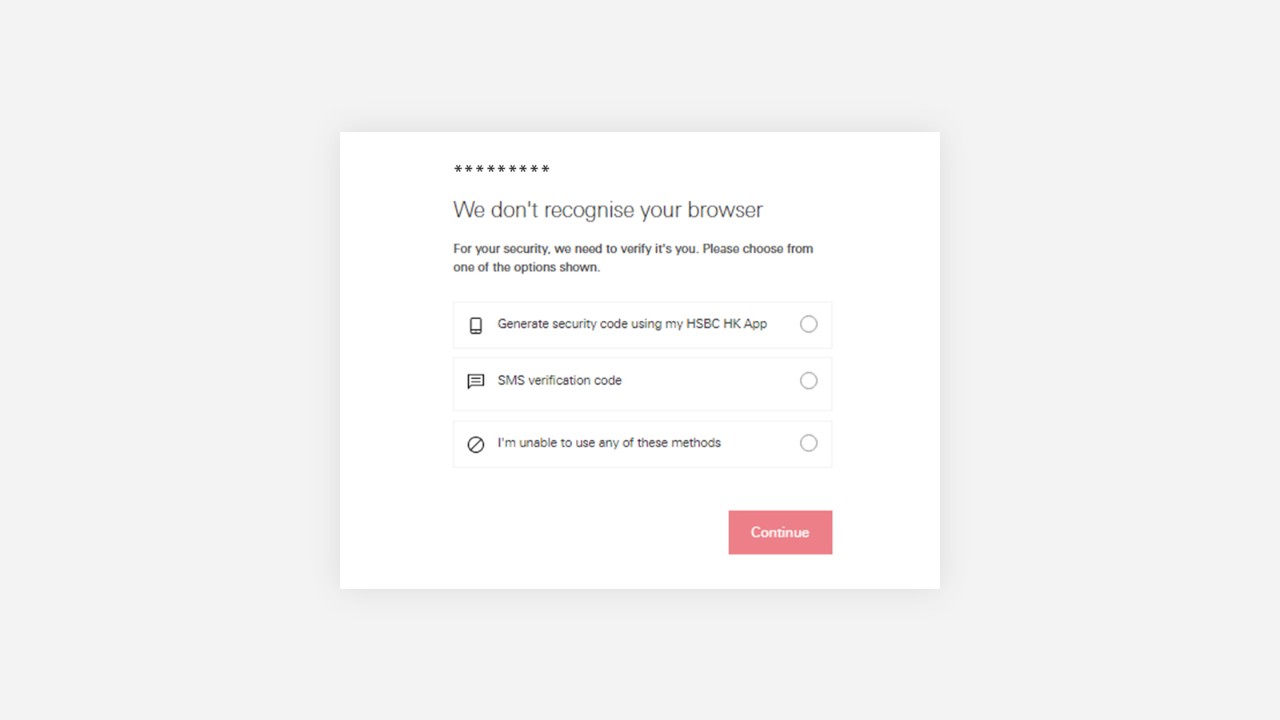

Log on to HSBC Online Banking

We have enhanced our security measures on HSBC Online Banking to protect your account from unauthorised access. You must create a Personal Internet Banking password before you can continue using HSBC Online Banking.

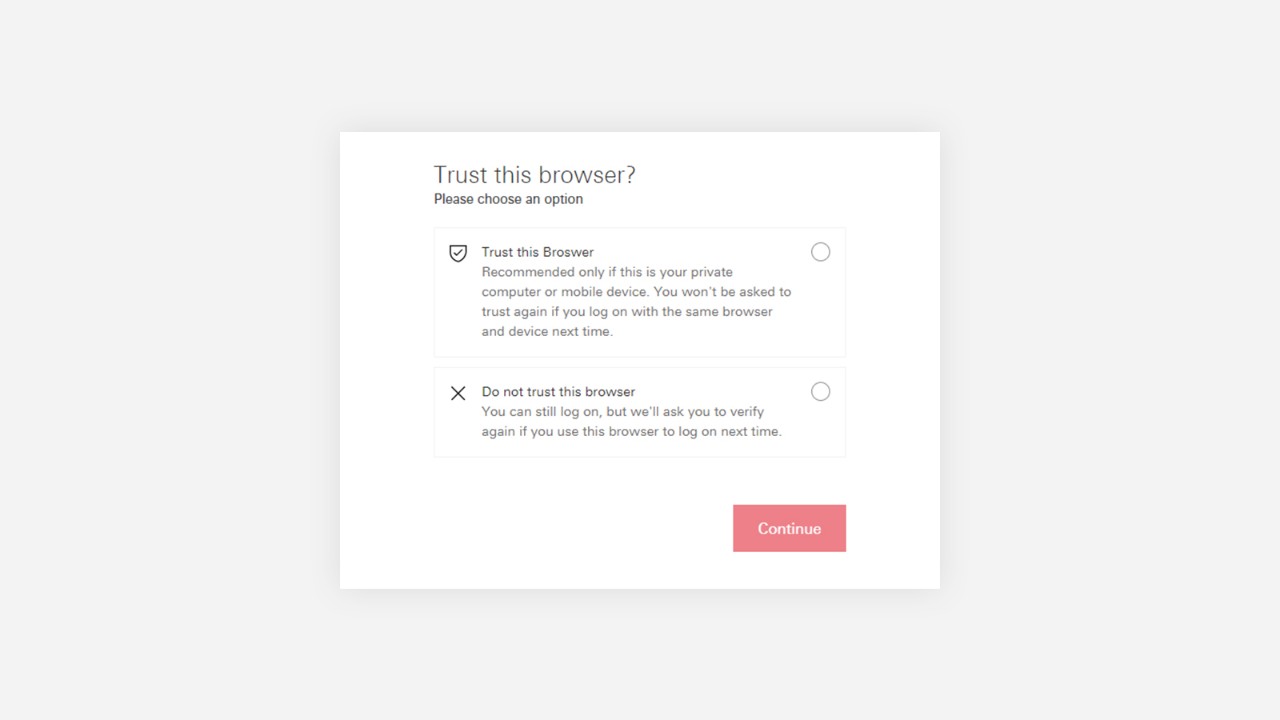

Also, if you are using an untrusted browser, you will receive a notification and be asked to confirm whether to trust the browser on this device. Trusting your browser means we will know it is you logging on, and you can do so seamlessly without additional verification in the future, but you should do this only if you are using a personal computer.

I need more help

Notes

- The screen displays and the images of the website are for reference and illustration purposes only.

- Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- HSBC adopts the latest internet security measure with the adoption of EV SSL Certificate (Extended Validation SSL Certificate). With this verification certificate in place, you can instantly know you are on an official HSBC website. We suggest customer to check the digital certificate with a desktop computer.

iPhone, iPad and iPod Touch with iOS/iPadOS version 15.0 or above (excluding Beta version)

Android™ devices with Android™ OS version 9.0 or above (excluding Beta version)